GUEST EDITORIAL

In a scene from “Austin Powers: International Man of Mystery”, Dr. Evil, waken from his cryogenic freeze, is ushered into a meeting with his top henchmen who are holding the world hostage on his behalf. When asked what they should demand, he responds “One Million Dollars”, to the chagrin of his compatriots, who have relative knowledge of its diminished value. Unfortunately, this humorous illustration of an ignorance of inflationary factors plays itself out every day in the repossession industry.

In 1996 International Recovery Systems was incorporated in Pennsylvania as a repossession business. In 2010 when the company came under new ownership, amongst the quality of service and results, a plan was implemented to retain recovery data throughout the years. The information retained has been instrumental in demonstrating both the health and success of the company, as well as how it relates to industry trends.

In relation to a similar Consumer Price Index article published on CUCollector in 2017 “The $500 Repo Fee”, the revenue per assignment is still the most important KPI when analyzing your clients. However, relative to CPI, revenue per recovery is the instrument to utilize.

The Consumer Price Index is set by the Bureau of Labor Statistics, it is calculated by BLS employees who identify 80,000 – 100,000 items a month and measure the change in pricing. The CPI has also been referred to as the “cost of living” indicator which helps define a reasonable living standard.

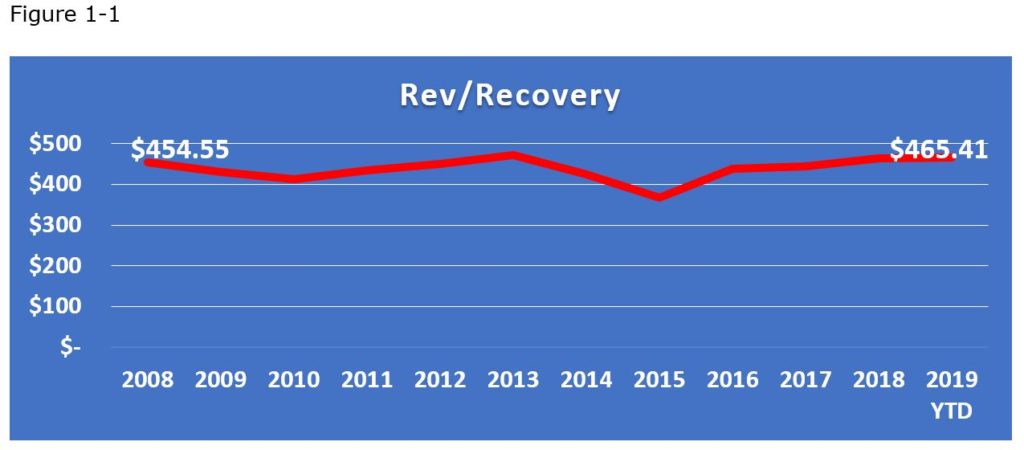

As shown below in Figure 1-1,

- IRS had a revenue per recovery rate of $454.55 in 2008. During this time, agents were able to bill for close fees, day one storage, and more direct, higher paying clients were in the industry.

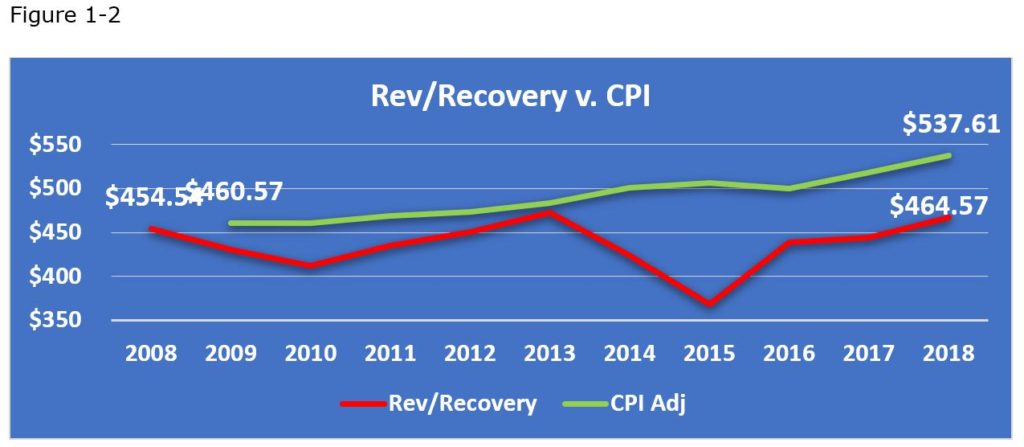

- However, during the past decade, the CPI has increased 18.12%, while IRS’ revenue has increased 2.39% as illustrated in Figure 1-2. Moreover, once those ancillaries were removed from the agent, the agent still needed to provide the service of storage and find a way to subsidize the assignments not located.

- The fall between 2013-2015 was due to two large clients that left the direct model and went to the forwarding model, and with that went higher recovery rates, close fees, and extended storage.

Revenue per recovery pays for the assignments not located, which inherently are the most expensive assignments. With no way for the agent to capture the costs of running these assignments, they drain on the income derived from the others.

For International Recovery Systems to recover from the 2015 decline in revenue per recovery, we needed to invest in LPR technology as well as becoming a full locksmithing company, which required large capital, to an already vulnerable company. Fortunately, IRS has enough capital to invest in these products whereas other agents have not been so lucky. Since that time, IRS has been able to re-position itself as the leader of the repossession industry in the Philadelphia Market.

Compounding the issue, IRS has seen an 850% increase in compliance costs (various certificate and continuing education exams) from 2008-2018, a 17.65% increase in Ford F-450s, as well as insurance premiums doubling, at 112% in the same time period.

Managing costs is a challenge in and of itself, however, while knowing you will not be increasing your revenue proportionally to CPI, the task becomes cumbersome and nearly unsustainable. Not only does the CPI demonstrate goods and services across the country, but defines your standard of living.

The bottom has been reached and we’ve been tossed a shovel to dig deeper. If repossession fees remain stagnant or decrease while ancillary income derived from storage and other services are taken away, repossession agents will continue to struggle until there are none left.

Comical “Evil Genius” Dr. Evil was asleep in a cryogenic freeze. He had an excuse. It’s your time to wake up. Know your numbers!

Andy Sinclair

Senior Manager /International Recovery Systems

Facebook Comments