A Record Setting Year in More Than One Way

2025 was extremely busy year for the repossession industry with some very interesting stories. And, while I share with you the year’s top ten stories, what is not on the list is what I am most pleased with.

Up front, this list is compiled by the number of views by visitors to the post and not by my own consideration of significance. One thing you will find is that there were some stories that caught the attention of a lot of people outside of the repossession community.

So, with no further ado, here are 2025’s top stories!

#10 – Repossession Volume by State

#10 – Repossession Volume by State

Up front, when I wrote this article, I had been trying to replicate the repossession volume model used by Cox Automotive. It wasn’t until soon after that John Sibbet provided me the RDN data which blew up the Cox Automotive data and provided the world its first true and direct data driven reports on repossession volume. Read this and then the RDN data story only if you want to see how far off I was.

#9 – The Big Mac Index and The Repo Fee

#9 – The Big Mac Index and The Repo Fee

It had been a couple of years since I had whipped out the whiffleball bat and gave that putrid rotting dead horse carcass a good whacking. So away I went off and compared the cost of a Bic Mac to the cost of a repossession of the same periods to once again illuminate the absurdity of the state of industry. If you’ve never read it, please do and try not to get suicidal or quit the industry over it.

#8 – Federal Government Shutdown Triggers Repossession Moratorium!

#8 – Federal Government Shutdown Triggers Repossession Moratorium!

Out of the blue, the state of Nevada revised a state statute that created a moratorium of repossessions on federal employees or their spouses in the end on a government shutdown. Lo and behold, what did we get? A federal government shutdown. Fortunately, it wasn’t long lasting, but did cause a lot of concern in Nevada as well as anxiety about copy-cat legislation elsewhere as well at the federal level from DC.

#7 – Top Ten States for Repossession Volume YTD Q3 2025

#7 – Top Ten States for Repossession Volume YTD Q3 2025

This data again came from our friends at Recovery Database Network (RDN). This data is very enlightening and valuable for all in the industry in that it provides the first and only granular glimpse at where and how much repossession volume there is out there. Of course, the total volume for the year caught all the attention, but this is another data set that would be nice to keep an eye on in 2026 if available.

#6 – Hundreds of Repo Agencies Listed in Tricolor Bankruptcy

#6 – Hundreds of Repo Agencies Listed in Tricolor Bankruptcy

Before their well-publicized meltdown, I’d honestly never even heard of Tricolor. But it didn’t take long for me to learn just how much inventory sat on lots with their names on them as well as unpaid repossession bills. With a bankruptcy petition creditors list of over 26,000, a little digging in the list exposed that conservatively, over 300 repossession agencies were about to get the shaft.

Of course, fast forward a couple of months and the legal silver bracelets got slapped on their executive staff once their blatant fraud came to light.

#5 – First Annual Southeast Regional Association Conference

#5 – First Annual Southeast Regional Association Conference

This one surprised me a little when it popped up as number 5. This was a press release for the actual conference which had not year occurred but clearly drew a great deal of interest. It’s pretty unusual that a conference announcement would draw so much interest, but from all accounts, it was a huge success. Expanding to two days, I expect this conference will only grow in attendance and popularity.

#4 – Westlake’s Tone-Deaf Messaging on Flatbed Fees

#4 – Westlake’s Tone-Deaf Messaging on Flatbed Fees

Earlier in the year, Westlake’s messaging to their agent network that had everyone scratching their heads wondering what was going on at the otherwise solid Westlake. As if their apparent mistrust of their agent network in the prior demands (we’ll get to that shortly) wasn’t bad enough, they made demands that agents provide photographic proof from the field that a flatbed or dollies were used in order to get payment for the fees.

Exasperating things, they provided their definition of what a flatbed is and a what is a dolly and then that was wrong. They of course corrected themselves, but I let it go. Wasn’t worth causing them anymore grief, they were having some issues going over there and didn’t need my dogpiling on them.

#3 – Wife of Murdered Repossession Agency Owner Finally Arrested

#3 – Wife of Murdered Repossession Agency Owner Finally Arrested

When this murder occurred, I had yet to begin CUCollector or CURepossession and was unaware of it. I first reported this story back in 2021 when it caught my attention from an episode of “Cold Justice” that reopened the case.

When I first heard of the wife’s arrest, it was early in the morning last week when a prominent member of the industry from Houston texted me about it. It wasn’t even in the press at the time. Fast forward a few hours and the story blew up nationally, mostly from Texas. Had this story happened earlier in the month or year, it probably would have overtaken the number one story of the year. With the wife’s first hearing scheduled for February, perhaps we’ll hear more about this soon.

#2 – Westlake Clawing Back Paid Milage Fees – Agents Furious

#2 – Westlake Clawing Back Paid Milage Fees – Agents Furious

This article began as a message from an agency owner to me about the ludicrous and unfounded demands from Westlake that accused the agency of charging Westlake for billed mileage that was not earned. This was Westlake’s first and probably worst professional faux pas of the year. #4 on our top ten list followed this message by only a week or two.

To my understanding, when confronted with the facts, they never pursued it any further nor did they apologize for the error.

#1 – RDN Repossession Volume Report – Q3 2025

#1 – RDN Repossession Volume Report – Q3 2025

First and foremost, I’d like to once again thank John Sibbet and the folks at RDN for providing this data throughout this year. It was definitely illuminating. So much so, that it caught the attention of thousands of people not in the repossession industry as well as national and international press. This article drew the press into conducting many interviews with many of us from everyone from Newsweek to The UK Guardian, and numerous other media sources and local news channels.

While the additional attention wasn’t a big distraction to RDN, I have discussed it with them and future data releases are up in the air. Let’s hope we can at least see the year end results!

It’s a Wrap!

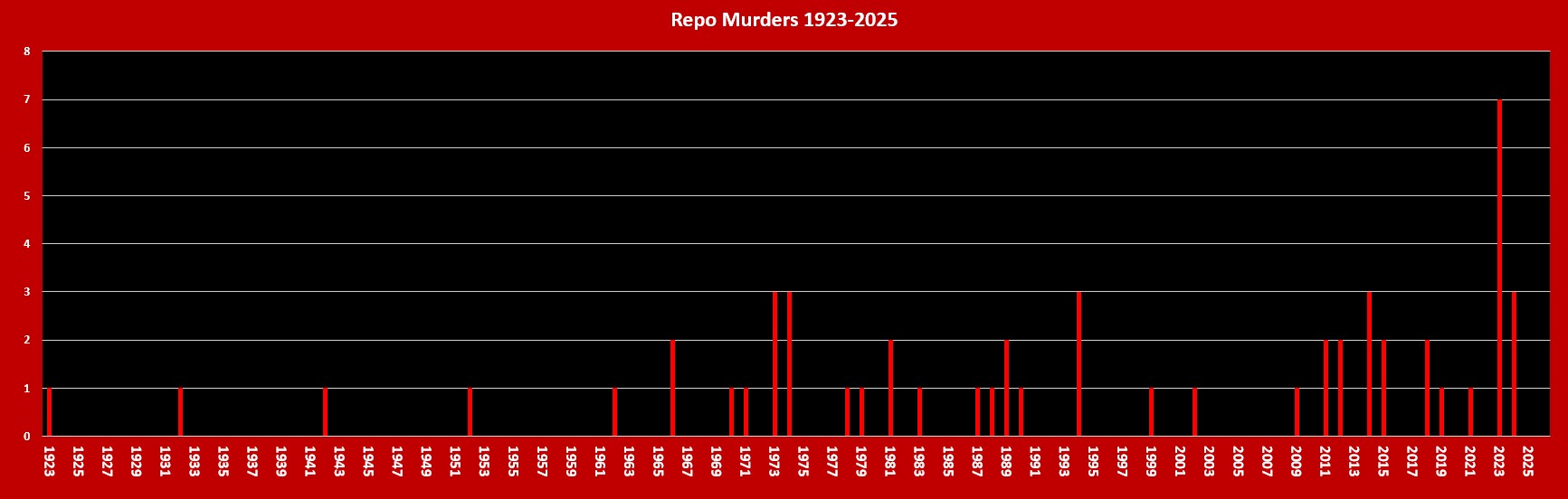

While there are still a couple of days left in the year and I don’t want to jinx it, there is one story that did not make the list. That is because of what didn’t happen. No one was murdered on the job. 2025 was the first year the repossession industry went without a murder since 2017.

Considering 2025 was the year with the highest repossession volume in over 15 years, that is a serious accomplishment. I believe that this is due to the phenomenal efforts of everyone in the industry in training their agents well.

You are all to be applauded for this and let us all pray that this becomes the “new normal” in 2026. No car is worth dying for.

Also missing from the list are all of the great the guest editorials written by so many of you. And while none of these made it into the top ten list this year, they are critical to the industry, so please keep them coming. It is all of you that keep this site running and I am in debt to all of you.

As I close out this story, I would like to thank all of you for your contributions and support through all of these years. I look forward to seeing you all again in person and talking with you in between. I pray that 2026 is a prosperous, joyous and safe year for everyone one of you.

Kevin Armstrong

Publisher

More Stories

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control