Editorial:

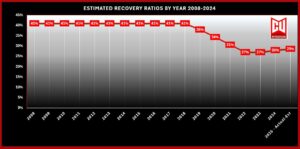

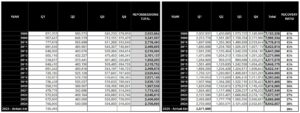

Back in January, the Consumer Financial Protection Bureau (CFPB) issued their long-awaited report on lender repossession data that reported that the repossession recovery rates for the examined lenders decreased from 38% to 27% between 2019 to 2022. An 11% decrease is significant, so, what is the cause of this?

According to the CFPB data, the share of repossession assignments completed decreased in 2022 compared to 2019. In September 2022, which is the last month for which we have full information about the outcome of a repossession assignment, 27 percent of accounts assigned to repossession were completed, a decrease from the completion of 38 percent of repossession assignments when compared to September 2019.

As someone who managed a repossession agency in the 90’s, we viewed any client with a recovery rate of less than 40% as poor and if much lower would quit accepting their assignments. As a collections and recovery executive in the 00’s-10’s, I saw an agency with the same ratio as a poor performer and would likewise cut them off.

I always viewed recovery ratios as a major key performance indicator (KPI) of performance. Call me a hard ass if you will, but I expected performance regardless of whatever chair I was sitting in.

So, now that we’ve seen an 11% reduction in recovery rates over a 3-year period, what does that say? Was it simply a matter of pandemic era assignment strategies? Was it people moving around more and creating more skips than in the past?

Whatever it says, It says that something has changed. Perhaps numerous things have changed or perhaps have simply become significantly worse. This dramatic discrepancy invites a closer examination of the practices within the lending and repossession sectors, revealing several possible underlying issues:

High Volume Diluting Coverage

Ask anyone in the repossession industry and they can tell you that they’re busier than they’ve been in years. Unfortunately, it begs the question, are Repossessors, fearful of losing clients, accepting more assignments than they can properly service during peak recovery hours?

Timing of Assignments

There’s a highly probable correlation between when accounts are assigned for repossession and when they should for optimal recovery. Assignments that come too late in the delinquency cycle result in vehicles that are already hidden by borrowers further lowering recovery chances.

Timid timing of assignments is a possible issue. Data on days delinquent year over year, would have been a great data point for the CFPB to capture.

Consumer Awareness and Evasion Tactics

As consumers become more aware of repossession technologies, some might employ tactics to evade repossession, such as keeping them locked in garages or backyards, switching plates or parking them in locations less accessible to tow trucks and LPR-equipped vehicles. But this nothing new.

Quality vs. Quantity of Leads

LPR historical hits and broad skip tracing data might provide more leads, but not all leads result in successful recoveries. Quality of leads will always lead over quantity. When an agent receives an assignment with multiple addresses, the focus and consistent coverage of the assignment is diminished as their time is spent chasing low quality leads.

Assignment to Multiple Agencies

The practice of assigning the same account to multiple repossession agencies in hopes of increasing recovery rates is not only counterproductive but is also unethical and highly dangerous. This duplication of efforts wastes agents time, fuel and reduces their focus on accounts with legitimate leads.

Even worse, duplicate assigned accounts can lead to violent incidents between previously encountered borrowers as well as other agents. This practice diminishes the agencies perception of the clients account quality leading to diminished efforts.

Lack of Coordination or Data Sharing

The disconnect between lenders and repossession agencies in terms of real-time data sharing is a significant hurdle. Without up-to-date information on debtor status or vehicle whereabouts, even the best technology and efforts are rendered ineffective.

When lenders do not monitor new demographic information of activities on other active accounts, they are missing often significant intel that could lead to recovery.

Fee Structures and Incentives

Current fee structures and contingent assignments often fail to align with the complexities of modern repossessions. If agencies are paid flat fees, there’s little motivation to pursue difficult cases beyond a few drive-by’s. Paying an agency what they’re worth is the top way to assure that they are putting forth their best efforts.

The Three Stage Assignment Strategy

Lenders as repossession forwarders often apply a three-stage assignment strategy. This entails a first placement to an agency, usually employing a 10 to14 day window for the agency to recover it before reassignment to a second agency. Stage two a similar window followed by a third.

Absent any closing fees, the lenders and forwarders have no imperative for a quick recovery and are relying upon luck more than a tenacious or diligent effort.

Over-reliance on Technology

While technology like LPR has revolutionized how vehicles are located, without sufficient operational support, including well-trained personnel and integration into broader recovery strategies, its impact is limited.

Technology is not a panacea, a cure-all, for recovery. The cameras don’t pick up cars. It requires striking while the iron is hot; allowing the agent that first spotted it to pick it up. Assigning to prearranged LPR carrier favorites reduces recovery time, can cause dropped balls and create discourse amongst the LPR camera operators..

Lenders Overly Desperate to Avoid Repossession

While a repossession is more often than not going to result in a charge off loss, it at some point is required. In order to avoid this, Lenders can often be too reluctant to face the facts and kick the can down the road by employing overly liberal loan modification standards. In addition, some send unnecessary “right to cure” letters warning borrowers of specific dates that they will be assigned for repossession only hinders recovery.

These practices are far more prevalent than most would believe.

No Contact Demands

For many years now, lenders have required agents to avoid contact with borrowers. Contact that could develop leads to recover collateral quicker. Contact, that, once upon a time led to borrowers to surrender the collateral location without incident.

“I was wondering when someone was going to come by.” was once upon a common response to an agent making a simple knock on the door. Amongst professionals, it wasn’t about threat or coercion, it was having direct and honest conversations with borrowers. Good agents were skilled communicators, a skill set long lost to the thirty mile an hour drive by LPR scan environment of the modern era.

Data Accuracy and Currency

The effectiveness of any repossession strategy hinges on the accuracy and timeliness of the data provided. Outdated or incorrect information leads to wasted efforts and lower recovery rates.

Conclusions

The takeaway from the CFPB’s findings is clear: the repossession industry must evolve beyond simply accepting more assignment volume. Agents need to adopt a more strategic approach to assignments, focusing on quality over quantity, timely actions, and robust communication with both agencies and consumers.

Only then can we hope to see recovery rates that reflect the capabilities of modern technology rather than languishing behind the number of assignments made. The challenge is not just in recovering more vehicles but doing so in a manner that’s efficient, ethical, and economically sound for lenders and Repossessors alike.

Lenders are adopting skittish and anemic reality avoidance strategies to avoid the often inevitable, are only girding borrowers to avoid repossession. Borrowers who are already employing a wide range of repossession avoidance tactics easily accessible by the internet.

Fears of litigation from negative contact incidents have rendered the simplest of tactics to recovery into obscurity. Communication, a tactic once an agents most powerful tool, is now forbidden. Despite the growth in adoption of body cameras, capable of providing documented video and audio evidence, this prohibition continues to exist.

The miracle of license plate recognition technology, once thought to be the Prometheus, the fire bringer, of the industries future, has according to many, turned into a “favored partner” relationship that has rendered a large portion of agency efforts and investments into feeding a data pool not necessarily benefiting them.

Since the dawn of auto repossessions, the arrangement between lenders and agents was account resolution. Get the car or get the lender paid. And when the lender closed the assignment, by getting paid or desiring to employ skip tracing efforts, the agency received a closing fee to compensate their efforts.

But lenders managed to steer the industry away from closing fees in exchange for higher volume and contingency became the new law of the land. Lost in this was diligence from both parties. Ever since, no one has had any “skin in the game” to improve.

This high volume, low return strategy has proven ineffective compared to those of the past. As a result, recovery ratio metrics have suffered dramatically. This has caused dramatic losses to lenders and financial strain to the repossession industry.

The result has been stagnant recovery fees that erode the ability to provide even basic benefits and pay to employees and is a disservice to those who put their lives on the line for this critical element of the auto manufacturing and lending ecosystem.

Back to the Basics

Improving recovery ratios serves lenders and agencies alike. Through improved recovery ratios, lender losses are reduced and net income improved. This leads to looser underwriting standards and lower rates. This provides more opportunities to the consumer public and everyone is better off.

There is no one “magic bullet” to fix this. As shown, there are many broken pieces to this and many friction points that need smoothing. From time to time, we see a lender or forwarder brave enough to make an effort to employ “back to the basic” tactics.

Perhaps it is time that everyone get back to basics. It just might serve everyone equally and improve recovery ratios.

Kevin Armstrong

Publisher

Related:

Repossession Assignment Volume UPDATED – 2008-2024

Repossession Volume Remains Strong in Q1 25’

More Stories

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control