Ten States Account for 59% of All Repossessions Nationwide

It’s clear that 2025 is shaping up as the biggest year for auto repossession volume since the Great Recession. But not all of that volume is spread across the nation evenly or even proportionate by population. So, which states carry the bulk of this?

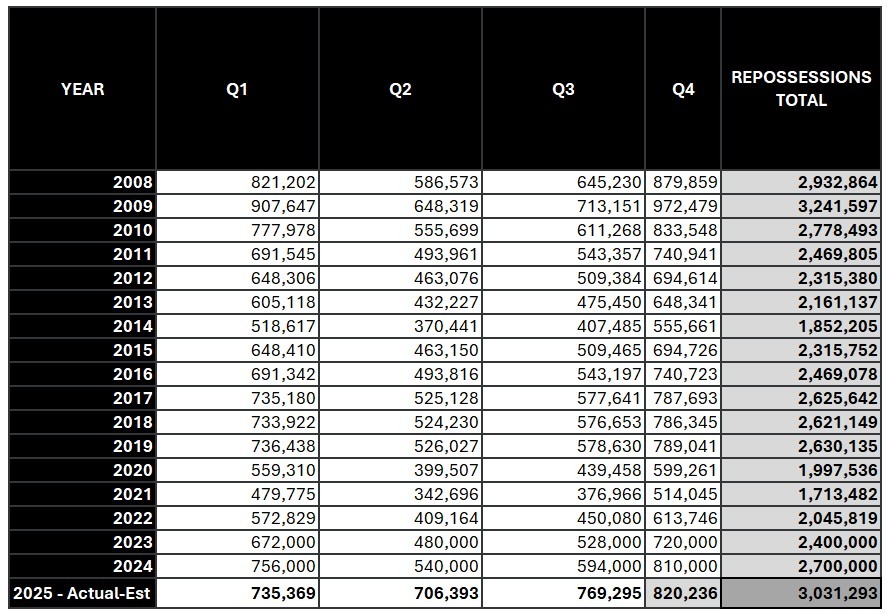

As reported earlier this month, according to data provided by Recovery Database Network (RDN), 2025 is on course to set the record for the highest level of repossession volume in recorded repossession history.

With 769,295 repossessions in Q3 alone, the data shows that there have been 2,211,057 repossessions recorded by RDN year to date (YTD). With the 4th quarter traditionally displaying the highest spikes in delinquency, the repossession volume tends to follow along and even if the volume is the same as in 2024, it will exceed 3M by the end of the year.

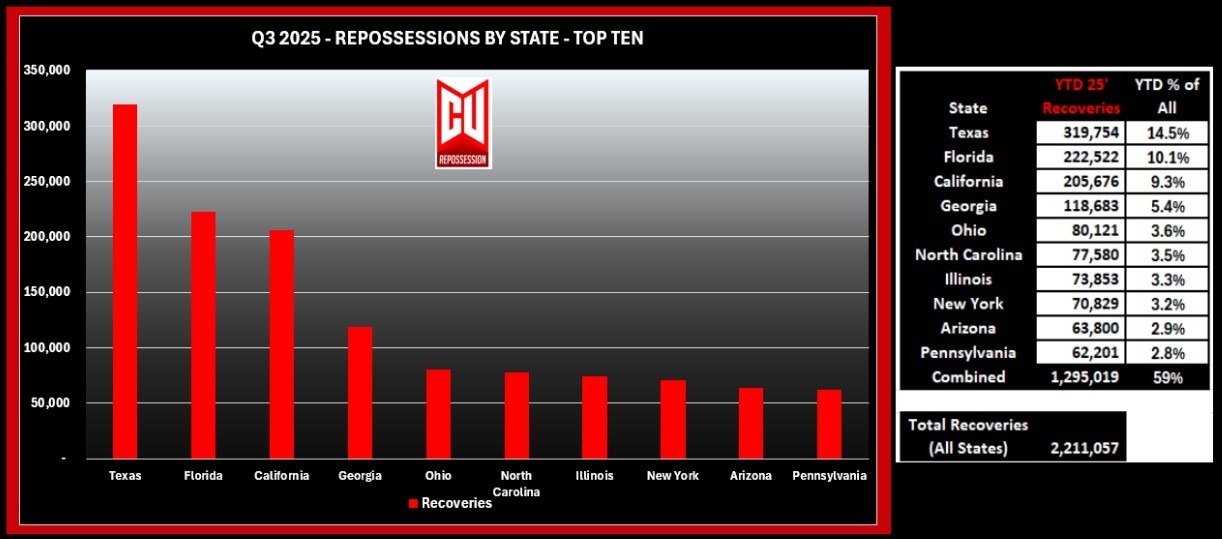

But not every state is experiencing this volume in the same way. Ten states account for 59% of all of the repossession volume. Not only this year, but for many years before it as well.

Top Ten

As expected, Texas leads the way for number of repossessions. With almost 319,754 repossession year to date, they stand a full head and shoulder above the next highest, Florida.

Combined, these ten states accounted for 1,295,019 repossessions. As previously stated, this accounts for 59% of the total 2,211,057 repossessions conducted through the RDN portal as of the end of Q3 2025.

Repo Rate by Population

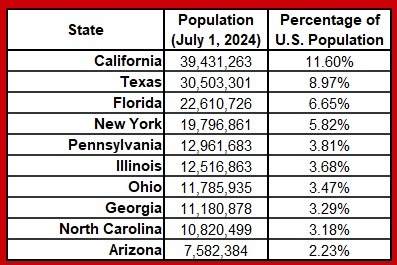

Logic would tell you that the states with the highest populations would have the highest number of repossessions, but that’s not the case. For example, California, with 11.60% of the US population, only ranks as number three on the above chart and New York, fourth highest in population, ranks as the eighth highest in terms of repossessions.

Logic would tell you that the states with the highest populations would have the highest number of repossessions, but that’s not the case. For example, California, with 11.60% of the US population, only ranks as number three on the above chart and New York, fourth highest in population, ranks as the eighth highest in terms of repossessions.

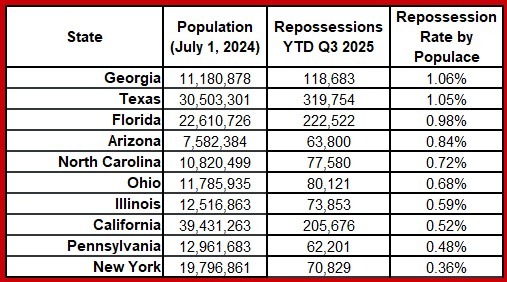

To see where the most repossessions by population occur, we need only to divide the population of a state by the number of repossessions by state. From this we can develop a population repossession rate.

Looking at this ratio, we can see that Georgia, ranked fourth in repossessions and eighth by population, has the nation’s highest population repossession rate. While they edge out Texas by a small margin, Arizona, ninth in repossessions and tenth in population, moves up into the number four spot.

Looking at this ratio, we can see that Georgia, ranked fourth in repossessions and eighth by population, has the nation’s highest population repossession rate. While they edge out Texas by a small margin, Arizona, ninth in repossessions and tenth in population, moves up into the number four spot.

The Real Numbers

As previously reported, RDN (Openlane) accounts for an estimated 90% of all repossession assignments. Getting non-duplicated repossession volume from other portals is nearly impossible. So, the actual number of repossessions, nationally and by state, are actually a little light as they won’t account for the other assignment portals or assignments that are directly assigned to small agencies and tow companies by small lenders and used car dealers.

Regardless, I feel that this data represents the vast majority of all repossessions conducted nationally. I once again thank John Sibbit and the fine people at RDN for sharing this data with us.

Regardless, I feel that this data represents the vast majority of all repossessions conducted nationally. I once again thank John Sibbit and the fine people at RDN for sharing this data with us.

Stay safe!

Kevin Armstrong

Publisher

Related Articles:

RDN Repossession Volume Report – Q3 2025

RDN Repossession Volume Report – Q2 2025

Repossession Volume Remains Strong in Q1 25’

Uncovering the True Size of the Repossession Industry in 2024

Repossession Assignment Volume UPDATED – 2008-2024

2008 -2024 Repossession Volume – 17 Years of Crisis and Comeback

CFPB Issues First Detailed Repossession Data Report

More Stories

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control

When Oversight Becomes Overreach: Why Demanding Subcontractor Financials Is Wrong