Managing 2023 repossession volume with 2013 fees and infrastructure

EDITORIAL

Last month we reported on a Florida repo company who were so busy, members were having to wait weeks to pick up their personal property. In September we posted an Editorial from a well-known agency owner who reported that had reached the maximum capacity for vehicle storage on their lot and had to shut down recoveries until they had some redemptions or transports. These are symptoms of something warned about during the pandemic that has created an industry operating on the edge of the breaking point.

It’s been a long time since repossession volume has been this high. Business is booming for most everyone. But how can agencies sustain these levels when their lot and staff sizes are limited by fees that have come nowhere near keeping up with inflation?

You Were Warned

During the pandemic, when repossession assignments forced as much as 25% of the industry to close their doors, it was warned that in the future when volume returned, lenders would have difficulty finding agencies. While their issues are somewhat different, Harley Davidson Financials’ CEO aired that complaint just last May.

It has also been long warned that the elimination of storage and personal property fees was causing an erosion of income that was crippling agencies’ abilities to grow or increase staff levels. And of course, we have for over a decade warned that the stagnant repossession fee environment created by the nation’s largest lenders were unsustainable and at some point, would cause service coverage issues.

Well, that time has come. The examples provided are not one-off stories from isolated companies or flaws in management. These are solid and respectable repossession agencies whose only flaw is that the current fee income model has kept them from being able to grow their businesses to manage the volume.

Personal Property Fees

No matter what industry you are in, no one wants to look outside their office window and see an uninvited news crew and a reporter coming to their door. Well, that’s exactly what happened to the 25-year veterans at Specialized Towing and Transportation of Jacksonville, Florida back in November.

The issue that brought this about was borrowers having to wait extended periods of time to pick up their personal property. While the interviewing press could care less about why the situation exists, it is really the most important of the story because it is a problem that cannot be cured without changes.

Image a simple repo company that picks up an average of ten cars a day. That’s 70 a week, about 280 a month. Most have personal property and all of that property must be inventoried, removed and stored.

Vehicle redemptions and borrowers picking up personal property are easily the second most dangerous part of the repossession process. So, for safety reasons, borrowers must make appointments to do so. Using a simple 15-minute appointment window and allowing 6 hours a day to do so, the very most that can be managed is 24 appointments a day. That’s just above the daily recovery volume and manageable.

Now, imagine that repossession volume increases and you can easily see how that capacity is diminished.

Hire more staff. That’s the easy answer, but how? No one gets paid for these tasks anymore.

As it is, many agencies are buying large shipping containers to handle the overflow of personal property that must be stored up to 60-days in most cases and much of it is never recovered. There is no income in storing these and no income in having a full-time employee conducting these transactions.

All of this is paid for directly out of the repossession fee and there is no magic sweet spot in volume that can keep up with this.

While Specialized Towing was highlighted, I guarantee you that they are not alone. This is a problem that no one wants to talk about but is growing.

There is a cost for every service and the base repossession fee is proving to be insufficient to provide it efficiently. So, as long as the CFPB says that agencies can’t charge borrowers for their property and as long as the lenders refuse to do so as well, this problem will persist.

Vehicle Storage

Imagine if you can, driving back to your lot with a car on the lift, pulling onto the lot and having nowhere to park it. Sounds crazy, but it is a real problem. Back in September, ARA Board Member and President of International Recovery Systems of Kennett Square, PA, wrote an editorial titled; “The Good, the Bad and the Ugly of a Packed Repo Lot” where he lamented this very problem having occurred to them.

While proud of the never-before-seen volume of repossessions conducted safely by his staff, Jeremy was forced to face the problem that he knew was coming. The same problem he’d been preaching every chance he could to anyone that would listen. They’d reached their maximum capacity and until they could release or transport more vehicles, they couldn’t put new cars on the lot.

Shutting business down even for one night to clear room is lost revenue for the business and lost revenue for the employees. That is income that cannot be recaptured. All of that while still having to provide storage on the previous repossessed vehicles for free!

As Jeremy well-articulated; The obligation of providing storage for free or at very least below market rates has created a bottle neck that is difficult to maneuver out of. “Well Jeremy why don’t you just get another storage yard and keep pulling in cars?” I would be happy to answer that question.

First issue since Covid large investors have recognized the market for outside storage sites due to the needs of companies like Amazon, FedEx and UPS for example. Like the housing market these investors gobbled up as much existing land as they could thus increasing the value to purchase raw land more than a million dollars per acre to purchase, or tens of thousands of dollars to rent. These rates effectively push out smaller businesses who can’t compete.

Second, let’s assume I can find that deal and purchase, mortgage rates are between 7-9% depending on the type of commercial loan. A twenty-year mortgage on a 1-million-dollar loan with 8% interest is almost 10k a month of a fixed expense. That fixed expense doesn’t care how many cars you’re doing, and that bill is due for the next 240 months.

Finally, how does it get paid for? Today things are pretty good repo prices are becoming closer to what they should be. Some clients are paying record bonuses to have their cars picked up which is great. We as agents are happy for those “pennies from heaven”, but we know it is temporary. Agents like myself can’t commit to long term infrastructure builds on temporary wins.

Again, the base repossession fee coupled with lender demands for free storage are creating conditions that make even the best managed repo agencies incapable of sustaining operations at the current volumes.

The Root Cause

Question: How can a business sustain growth without the capital to expand?

Answer: It can’t.

In order for a repossession company to expand its business to keep up with increased volume that exceeds its current capacity, it must acquire additional storage space and staff. But like everything else in the current era, the cost of both has risen exponentially.

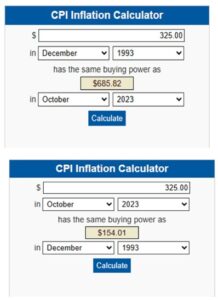

I think it’s been just over a year since I’ve beaten the dead horse of the $325 fee and I know that there has been some improvement, but last December when I checked, that persistent $325 fee that held solid for almost thirty years, should have been $603.45.

I think it’s been just over a year since I’ve beaten the dead horse of the $325 fee and I know that there has been some improvement, but last December when I checked, that persistent $325 fee that held solid for almost thirty years, should have been $603.45.

Fast forward one year and it is now worth $685.82. To add insult to injury, that $325 has the buying power of $154.01 now. So, before anyone goes and congratulates themselves for getting $450 a repossession, remember these numbers as the realistic value for your goods and services.

Also remember, that until about ten years ago, there were still other incomes that came with the repossession, like storage and personal property fees. Contingency assignments have become so mainstream that it almost seems like people have forgotten they even existed. That or like storage and property fees, they’ve just given up complaining.

Unlike the rest of the world, the repossession industry continues to operate under fee structures that has barely risen in twenty years. More critical to the cost of serviceNot only have they barely risen, but fees that used to be important elements of the operational income have ceased to exist.

This model has existed now for going on two decades. The lender’s hyperfocus on fee will continue to exist until they can no longer get what they want at that price point. Only then will they move the needle and only as much as they must to get what they want.

The national associations have been beating the drum in protest of the state of repossession and ancillary fees for years now, and they have made valiant efforts at both the lender and forwarder levels, their efforts have yielded minimal results at best.

I still encourage you all to join one of these fine associations. But membership in an association will never replace the value of fighting back against these conditions at the agency level. While unity provides greater strength, it is still incumbent on the agency owner to know and demand the true value of their service.

Blame the forwarders all you want, but like the repossession industry, they are competing against each other to gain assignment volume for the lenders. The price point is the primary driver of which forwarder gets the volume.

Don’t expect lenders to care that the repossession industry has reached the breaking point. They will only care when they can no longer get what they need,

and not one second more.

Kevin Armstrong

Publisher

More Stories

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control

When Oversight Becomes Overreach: Why Demanding Subcontractor Financials Is Wrong

Snitching vs. Standing on Principle: Calling Out Bad Actors in the Repossession Industry

Lender Interference in Georgia Repossessions