Editorial

Last Wednesday, an email was sent to agencies working forwarded repossession assignments for Santander and Chrysler by Plate Locate, that advised of a new change in vehicle storage terms that is intended to keep borrowers from having to pay storage on the repossessed vehicles until after the full reinstatement/redemption period of 20 days, as applicable in several states, has expired.

Please read the distributed email below;

From: Stephen Carter <[email protected]>

Date: 6/13/18 4:39 PM (GMT-05:00)

To:

Cc: Tim Mauz <[email protected]>

Subject: Santander Storage

Please make a note of this update to our client specific rules for Santander and Chrysler. Due to the state requiring the car be hold for 15 days, the client requires that we not bill for storage prior to 20 days. This usually isn’t an issue as the car is redeemed or transported. Please just make a note for the below:

Agents in the states of MD, CT, DC, and PA must allow 20 days of free storage for Santander and Chrysler accounts. Storage may be billed beginning on the 21st days.

As you can see, this is another “Fee Vampire” policy extracting income from the repossession industries livelihood under the pretense of compliance or consumer protection that quotes no legal or compliance precedence.

Santander Consumer reported a net income of $242M for the end of the first quarter of 2018 and is clearly under no financial pressure, with the exception of the never-ending drive for increased income. There is no legal precedence quoted nor CFPB memo, regulatory update or discovered legal requirement to predicate this demand.

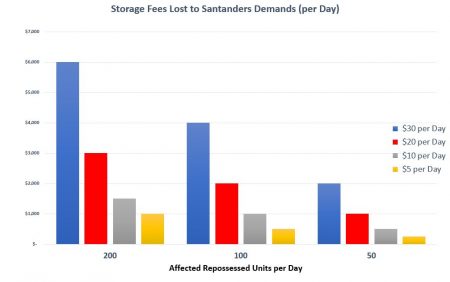

The effects of this, depending upon pre-existing storage agreements, to an agency with a minimal inventory of 50 vehicles being held in storage per day, for as little as $5 per day, could be as little as $250 per day, but in some cases, some larger agencies who hold as many as 200 of their units per day at $5 per day, the losses could be as high as $1,000 in lost fee income daily.

Obviously, inventory volume and fees may vary from agency to agency, but taking these numbers out to high storage amounts, the lost monthly incomes could be massive.

This demand appears to be based solely upon the whims of cost cutting on the backs of repossession agencies whose legally authorized fee incomes have been reduced to almost nothing and based upon the demands of large lenders like Santander to avoid any potential lawsuit humanly possible under any circumstances on any planet during any millennium while they reduce expenses to improve income. And, on the backs of the repossession industry, AGAIN.

Keep in mind, not every unit repossessed under this change would cost an agency money. Some will be sent to auction right away. Some will be reinstated or redeemed quickly as well. But rest assured, this free storage will certainly take the pressure off of the forwarders to have the vehicle delivered as quickly as possible and these non-earning units will languish at the repossession industries expense.

All of this is, of course, on top of the lost income in personal property fees, locksmith fees, transport fees and a flat $325 contingency fee that has remained the same for over 30 years while the expense of operations has increased over 300% via insurance and every other expense imaginable.

In the meanwhile, the forwarders receive $675-$1,000 per repossession, which they can pass on to the consumer in the event of repossession, reinstatement and, under the terms of a deficiency balance judgment.

HEY CFPB! How is this right when the repossession only costs $325?

Keep in mind, there is no stated “Rule” to this mandate. This is an exception. Just like all of the other exceptions the repossession industry has made to keep doing work for lenders like Santander Consumer. Each and every one of these exceptions erodes at the profitability and survival of the industry.

To quote an old Scottish phrase, “Many a mickle makes a muckle.”

To quote an old Scottish phrase, “Many a mickle makes a muckle.”

A “mickle” is a small amount of something. A “muckle” is a large amount of something.

Each of the exceptions the industry makes is a “mickle” and when you’ve made so many exceptions, you’ve made a “muckle.”

Once again, and this is probably the 100th time I’ve said this, I don’t blame the lenders or forwarders. I blame the repossession industry for continuing down this road of exceptions.

We teach people how to treat us, and the repossession industry has taught them to treat you very poorly.

Stand up. Say NO!

Editor

More Stories

Westlake Clawing Back Paid Milage Fees – Agents Furious

Ode to A Repossessor – 1947

Man Gets Slap on the Wrist from Court for Endangering Repossessor

2018 Annual Northeast Debt Collection Conference

Chase Pays Primeritus up to $800 on a Repo

23 Year Old Mother Allegedly Abandons Child Chasing Repo