Repossession volume of 6 of the 18 lenders reported are responsible for 93% of all ABS auto loan repossessions.

Among the nation’s largest subprime auto lenders, 24 entities serviced by 18 lenders package and sell for investment portfolios in auto loans known as asset backed securities (ABS). Being publicly offered investments, they are required to report in greater detail the performance of these pools to investors by the Securities and Exchange Commission (SEC). Within this data are loan level details containing 72 data points which include details of repossession volume.

The $126.0 billion securitized auto loan portfolios only amount to about 18% of the $704.0 billion in U.S. auto loans that were originated last year. It’s not huge but is a valuable canary in the coalmine for what is going on in the auto loan portfolios of many of the nation’s largest lenders.

Just for some background, auto loan ABS are financial securities backed by pools of auto loans, created through a process called securitization, where lenders sell their loans to issuers who package them into portfolios for investors. Lenders, including banks, credit unions, and automotive captives (e.g., GM Financial, Ford Credit), originate these loans and often act as issuers.

This is publicly available data at the SEC’s site, but it’s some pretty meaty and thick data which to look up manually would be extensively exhausting. Fortunately for me, I’ve made contact with a 32-year GMAC veteran named Bill Ploog of WCP Advisor who reports investment data for these assets. Using his custom developed scripts, he cuts through the bulk of this data and extrapolates some very valuable data.

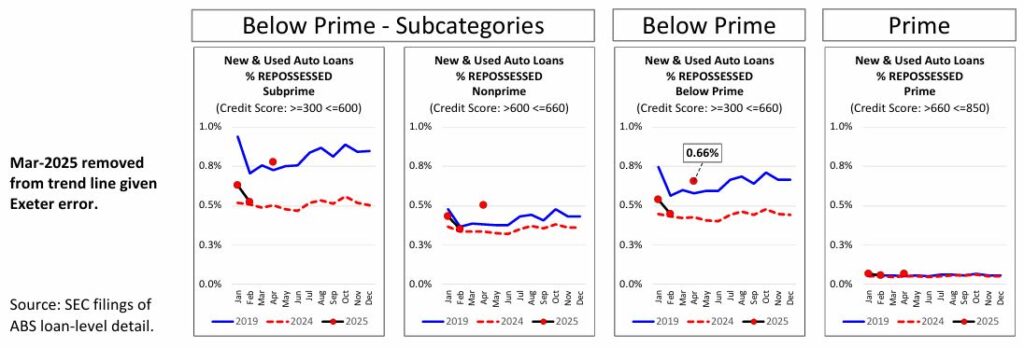

Repossession Ratios by ABS Credit Tiers

This data reports to us the repossession volumes by data tiers of subprime, non-prime, below prime and prime tiers for the years of 2019, 2024 and 2025, month by month using the previously discussed data from his reports.

Of interesting note is:

- Elevated repossession ratios in January of 2025 vs. prior study years and drops to 2024 levels in February.

- April showed spikes year over year in repossession volume in 2025 above 2019 and 2024 in all categories.

- Most notable increases occurred in the below prime credit tier which showed a 54% (23 bp) increase above Apr-2024 and a13% increase (8 bp) above Apr-2019.

- One variant in the pooled data comes from Exeter’s data which removed the March 2025 data. This is why there is no data on that chart area, Regardless, a trendline appears to be developing.

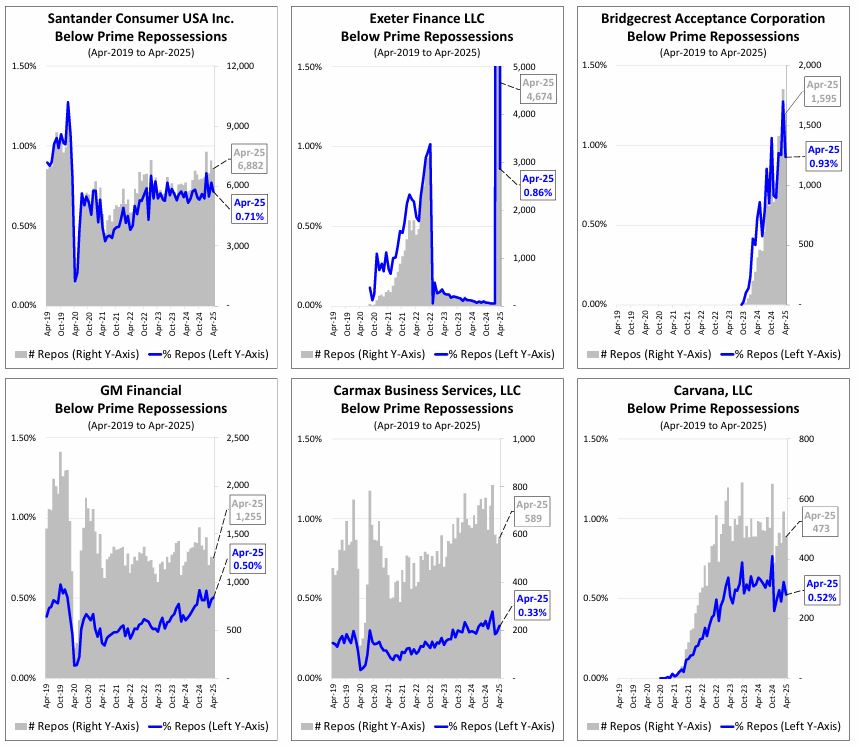

Highest Repossession Volume ABS Lenders

One of the most striking data points in Bill’s data is that the repossession volume of 6 of the 18 lenders reported are responsible for 93% of all ABS auto loan repossessions.

- Santander (SDART/DRIVE)–6,882 (43%) of total ABS repos–Highest number of repos of all ABS entities

- Exeter (EART / ESART)–4,674 (29%) of total ABS repos–See last page of section for Mar-2025 details

- Bridgecrest (BLAST)–1,595 (10%) of total ABS repos–Highest Apr-2025 repo rate of all ABS entities (0.93)

- GM Financial (GMCAR/AMCAR)–1,255 (8%) of total ABS repos.

- Carmax (CAOT/CMXS)–589 (4%) of total ABS repos.

- Carvana (CRVNA)–473 (3%) of total ABS repos. (Serviced by Bridgecerst).

All six entities reflected higher repossession rates in 2024. Santander has the highest repossession rate and is the largest single producer of repossessions in auto lending. While monthly fluctuations (saw-tooth pattern) are notable, repossession rates are generally rising.

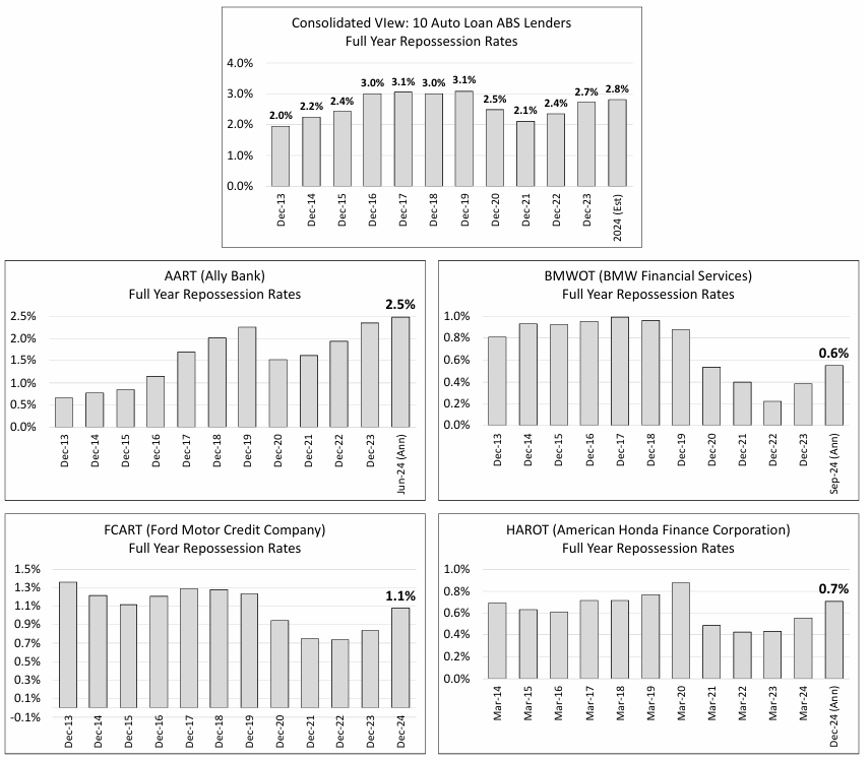

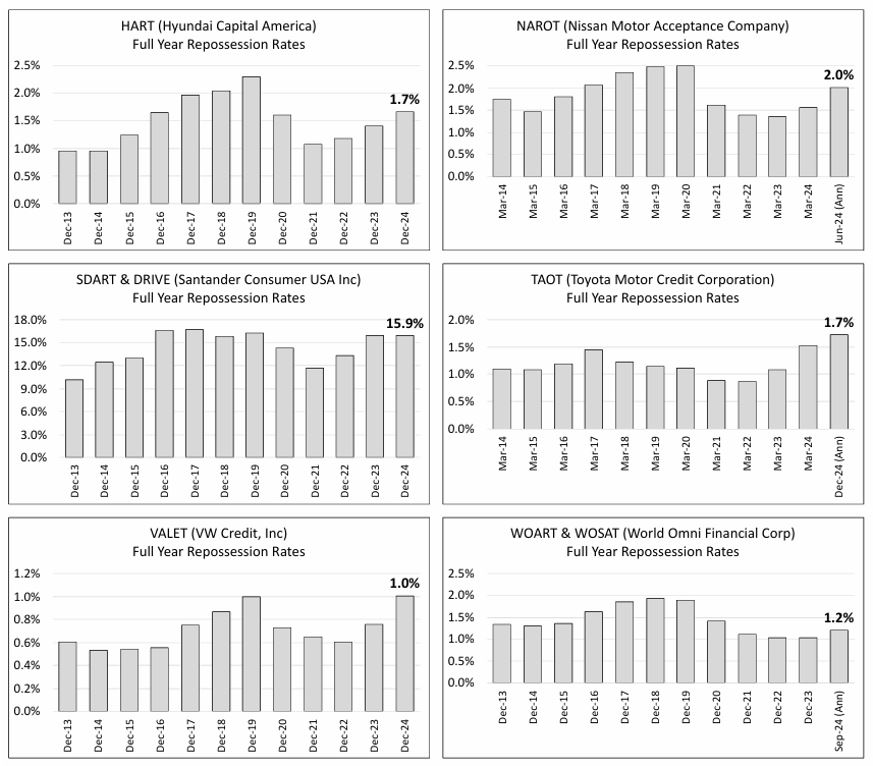

Auto Loan ABS: Annual Repossession Rates

- Images reflect repossession rates derived from SEC prospectus form 424(b)(5) or 424(h) for entities with active auto-loan ABS.

- Six of ten shown on this page, four shown on previous page.

– Note: Y-axis scale varies by entity to best display ratios.

– Note: Some entities FY ends in March.

- The most recent trust submission was selected for each entity.

- Data reflects an entity’s entire portfolio, not just that portion which is part of an ABS.–Santander (SDART & DRIVE) include what they classify as “sub-prime.”

- Following eight entities did not provide, in their most recent prospectus, data necessary to calculate repossession rates:

- BLAST • COPAR • CAOT & CMXS • CRVNA

- EART • FTAT • GMCAR & AMCAR • MBART

On a consolidated basis full-year repossession rates continue to climb from a pandemic era low point. All four entities reflect a higher repossession rate in 2024 … Ally reflects a 12-year high rate.

No Signs of Letting Up

It’s no surprise to anyone whose been paying attention to the auto lending headlines, subprime lending is dealing with some of the heaviest delinquency volume in many years. Bill Ploog and I had a long talk last week and discussed his reporting and his illuminating projections for 2025 as well as a good insight into what is really going on inside the ABS portfolios.

Last week, Bill posted to LinkedIn a post titled “First four months of 2025 … Ongoing Below Prime strain as seasonal climb towards peak delinquency begins”. Within it, he pointed out some very interesting data points that show just how bad the delinquency is in these portfolios;

- 44% of GM auto loans have received at least one loan modification. The lowest was 24%. This is evidence that the auto ABS lenders are doing their best to hold back delinquency and repossessions, but it only seems to be throwing sand against the proverbial waves.

- 85% of Bridgecrest loans and the serviced Carvana loans are repossessed after charge-off. Not a glowing stat for their repossession effectiveness.

Bill is not only a Data Wizard, he is also an old school lender that cut his teeth in GMAC in the early days of repossessing cars and collections before being given the lending pen. Yes, kids, lenders did their own repossessions clear into the early 2000’s. After 32 years there, is is now providing ABS investor data but shows a keen interest in repossession and lending activity.

He is preparing a special repossession report that will dig deeper into these SEC reports and should anyone wish to reach out to him, connect with him at his LinkedIn profile at Bill Ploog, WCP Consulting, LLC.

More Stories

A Repo, Gun Threats, Hidden Meth, and a Felon’s Desperate Hideout

ATR Driver Critically Injured in Semi Collision – Needs Help!

Tragedy Strikes Benchmark Recovery Family – Help Needed!

Gun to the Head: Conviction in the Slidell Repossession Nightmare

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo