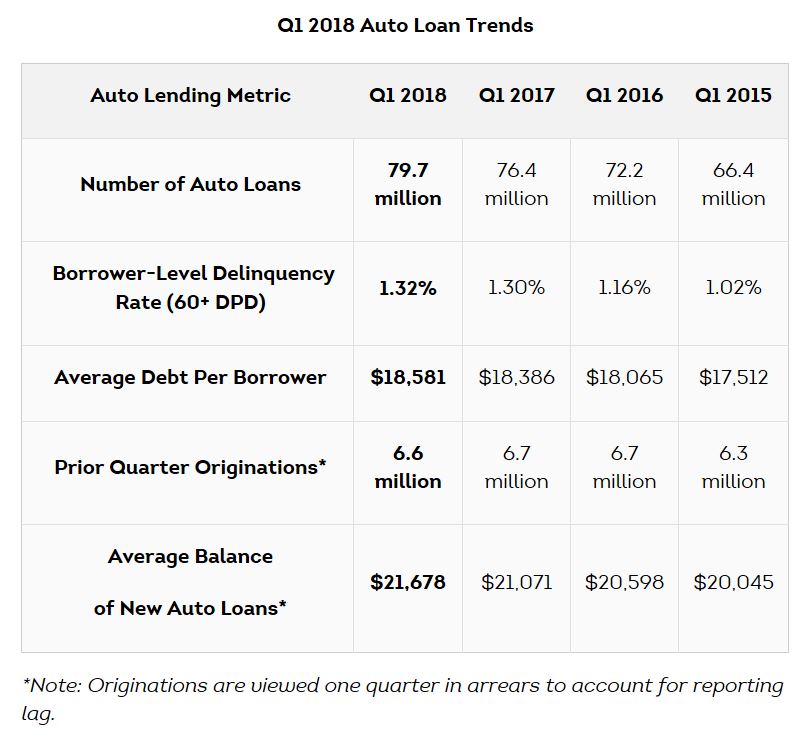

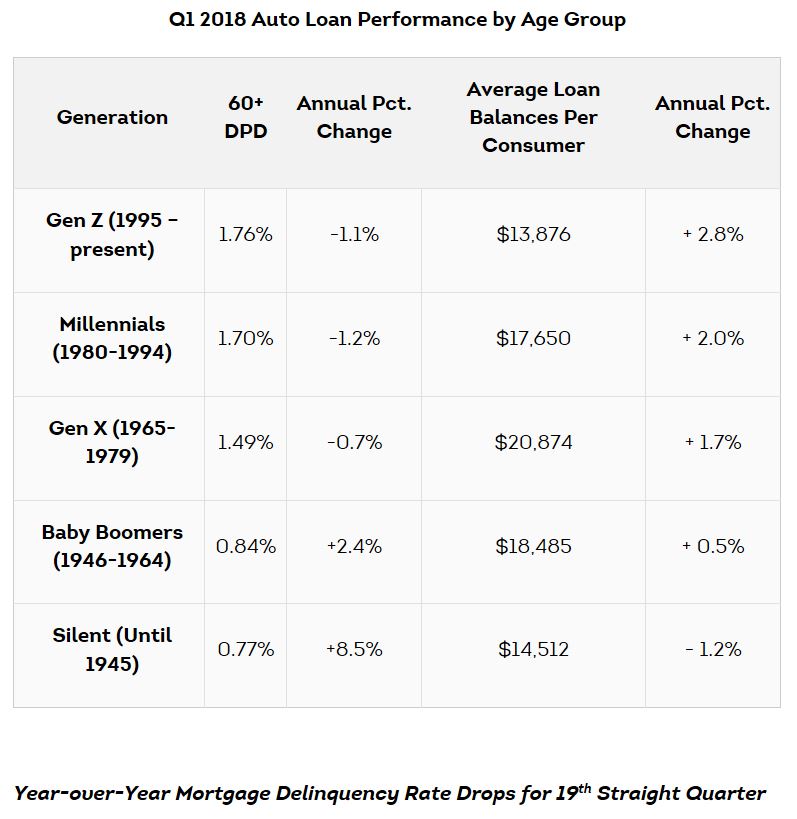

TransUnion’s Industry Insights Report found that tighter underwriting and improvements in the oil states appear to be positively impacting serious auto loan delinquency rates per borrower (60+ DPD). After growing from 1.16% in Q1 2016 to 1.30% in Q1 2017, the serious delinquency rate stayed relatively flat at 1.32% in Q1 2018. The top six states with the largest annual decreases in delinquency rates in Q1 2018 – Alaska, Wyoming, Texas, New Mexico, Oklahoma and North Dakota – are among the eight states where oil, gas, and mining account for 10% or more of gross domestic product.

The other two states – Louisiana and West Virginia – also performed better than the national average in terms of annual changes in 60+DPD rates for Q1 2018.

While total auto balances rose 5.2% to $1.183 trillion, this marked the lowest annual growth rate since Q1 2012, which at the time was 4.2% and on the rise. TransUnion also observed continued shifting in the origination makeup of auto loan borrowers, which continues to migrate to higher credit tiers. Overall originations, viewed one quarter in arrears to account for reporting lag, declined 1.5% in Q4 2017. This marked the sixth consecutive quarter of yearly declines, though the smallest such decrease in 2017.

Instant Analysis

“The first quarter of 2018 was relatively quiet in the auto finance space. The most noteworthy change was the stabilization in the delinquency rate, likely due to shifts in the makeup of new auto loan borrowers and continued improvements in oil states. Gas prices, as measured by WTI crude, have increased more than 21% in the last year, which has provided a significant boost to the local economies of oil producing states. Origination mix continues to shift toward lower risk, with super prime and prime plus taking 1.8 points of share from prime, near prime and subprime on an annual basis. This continues the trend from last year, where the shift to the two lowest-risk tiers was 1.6 points. Finally, we believe the slowdown in auto loan balance growth is largely due to the decline in originations, as lenders continue to tighten their underwriting requirements and rising interest rates put a slight damper on demand.”

Brian Landau,

Senior Vice President

and Automotive Business Leader,

TransUnion

Source: TransUnion

Read More!

More Stories

Westlake Clawing Back Paid Milage Fees – Agents Furious

Ode to A Repossessor – 1947

Man Gets Slap on the Wrist from Court for Endangering Repossessor

Santander Demands 20 Days Free Storage – There’s That Sucking Sound Again

2018 Annual Northeast Debt Collection Conference

Chase Pays Primeritus up to $800 on a Repo