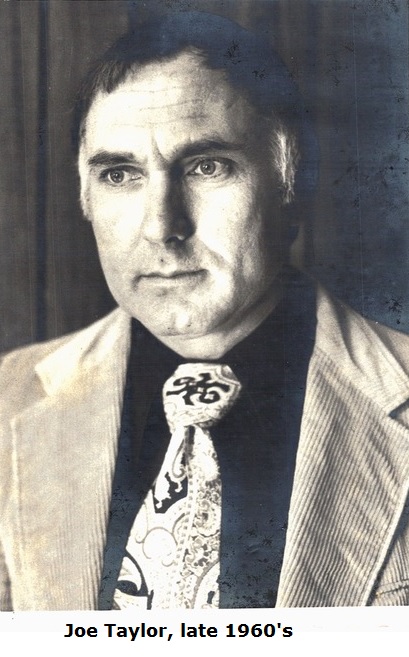

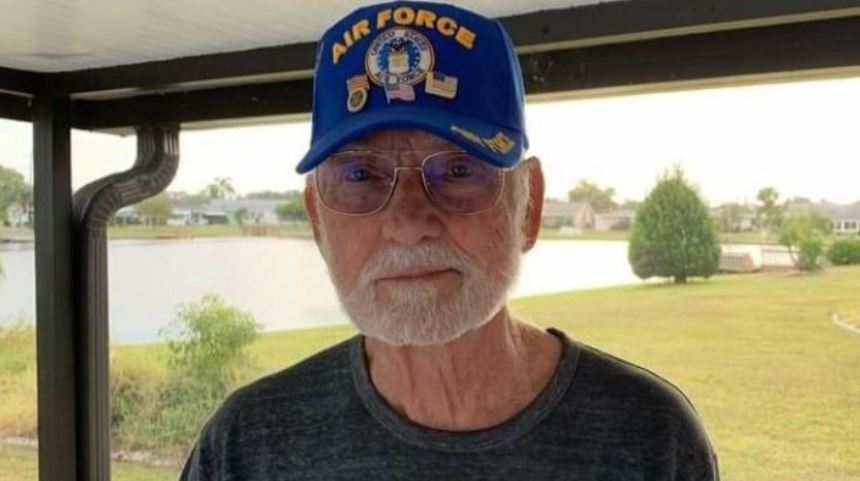

Several years ago, repossession industry pioneer Joe Taylor was going through some life-threatening health issues caused by Lyme disease. In his 80’s it was life threatening. Then, a few weeks ago I heard a rumor that he had passed away. Fortunately, that turned out to be false, and Joe is alive, kicking and on January 30th, will be celebrating his 90th birthday!

After over fifty years in the repossession industry. Joe retired about ten years ago. So, many of you have probably never had the pleasure of meeting him. The loss is yours; Joe is one of the nicest men you would ever want to meet. Here’s some brief history of him.

In the Beginning

Honorably discharged from the Air Force in 1959, young Joe Taylor became a police officer. Soon disenchanted with the “good-old boy” politics of a small-town police department, he took a job as an employee of Associates Finance Company in 1961. Below is Joe’s recollection of the repossession industry of the 60’s from a 2017 interview in CUCollector.com.

“Associates had an iron clad policy that their employees who handled repossessions were not allowed to repossess a customer’s car until you actually sat down with the debtor, looked at his income and determine whether he could actually pay for the car. Only after determining that the debtor could not afford the payments were you allowed to take the car. Could you imagine that process in today’s society? This training taught me the very important communications skills that served me well in the coming years when I had my own repossession agency. “

“Tow trucks? Didn’t need one. We either drove the car in or towed it with a chain hooked to our company car. Only if the tires were missing did we call for a roll-back. And, with a mostly non-transient society we didn’t hear much about skip-tracers.”

“It seemed that debtor’s “back then” realized that if they couldn’t, or wouldn’t pay for their car, they understood that repossession was the alternative and the potential for violence during a repossession was virtually non-existent. Two instances I remember well. One, we had a delinquent debtor in Daytona Beach, some 75 miles from our office. I got to Daytona on a Greyhound bus and caught a taxi to the debtor’s address. The debtor did not know I was coming and when I arrived and told him what I was there for, he gave me the keys to the pick-up truck.”

“In the other instance, the debtor lived in West Palm Beach, some 200 miles from my office. This time I contacted the debtor and advised my purpose for calling. The debtor advised that the car would be at his residence address. Again, I rode a Greyhound bus to West Palm Beach, caught a taxi to the residence where I found the car with the keys inside and I drove it back to my office. As I said, the industry was so very different “back then.”

In the years that followed, Joe would carry on becoming a pioneer in the emerging field of legal compliance. It could almost be argued that Joe invented it. Regardless of Joe’s more peaceful experiences in the field, conflict was never far away for many.

As previously discussed, throughout the history of auto lending, lenders and car dealers have conducted their own repossessions with great regularity. In the banking industry, collecting on your own loans was a standard that carried on well into the 1990’s.

Of course, this practice was not without its own obvious perils, especially in the hands of untrained and inexperienced persons. These risks, also extended to the general public with private party transactions, and often with tragic results.

Creating the Industry Standard

In early 1999, industry veteran Joe Taylor was tapped with an unusual request by the Empire Fire & Marine Insurance Company and AEON Insurance Groups. Create a nationally accepted repossession compliance certification program that meets the strict requirements of the insurance industry. After spending about 500 hours researching both the state and federal self-help repossessions laws, Joe was finished. By the end of the year, the Certified Asset Recovery Specialist program was born, known more commonly as CARS.

In early 1999, industry veteran Joe Taylor was tapped with an unusual request by the Empire Fire & Marine Insurance Company and AEON Insurance Groups. Create a nationally accepted repossession compliance certification program that meets the strict requirements of the insurance industry. After spending about 500 hours researching both the state and federal self-help repossessions laws, Joe was finished. By the end of the year, the Certified Asset Recovery Specialist program was born, known more commonly as CARS.

CARS was the first agent compliance program in the industries long history. As desired, it became the first nationally accepted repossession compliance certification program and is still the industry standard. Joe went on to speak and hold compliance classes to agents, lenders, law enforcement and politicians over the years to come. CARS is owned by Recovery Industry Services Company (RISC.)

By the end of the 1990’s, technology was coming on in full force. Fading and gone were the days of telephone spoofing, lock picking and slamming ignitions. Recoveries began to more resemble simple tow jobs than the sleuth and stealth like tactics of old. The very relationships between lenders and the agencies themselves were soon to be interrupted by forwarding and the industry would never be the same.

In addition to Joe’s career accomplishments, Joe had always been a frequent contributor of articles and editorials to CUCollector since its inception in 2010.

Time Takes it’s Toll

In 2020, Joe and his family received some bad news when Joe was diagnosed with Lyme disease, a debilitating disease causing him chronic pain, dizziness, fatigue and other debilitating symptoms. It was a disease that can be fatal if not treated aggressively by experts.

In 2020, Joe and his family received some bad news when Joe was diagnosed with Lyme disease, a debilitating disease causing him chronic pain, dizziness, fatigue and other debilitating symptoms. It was a disease that can be fatal if not treated aggressively by experts.

The costs of these treatments are very, very expensive but Joe’s son Brian and his wife Beth managed to raise the funds and received treatment in Mexico. While this provided substantial relief, Joe had later required full time care and was moved into an assisted living facility in Ocala, Florida.

As I’d mentioned earlier, I had heard a rumor that Joe had recently passed away but soon found this to be unfounded and learned that Joe was alive and well. Sunday morning, I received an email from Joe’s wife Beth advising me that Joe was indeed alive and well and would be celebrating his 90th birthday on January 30th.

A Call for Celebration

As I’d also said earlier, a lot of you may have never met Joe, but I know many of you have. For those of you who would like to show your respects to Joe celebrating his 90th birthday is on January 30th, I know that his heart would soar to hear from you on this special occasion.

Cards, flowers and other gifts of appreciation can be sent to:

Joe Taylor

C/O Paddock Ridge Assisted Living

Apt. #108

4001 SW 33rd Ct.

Ocala, FL. 34474

Office Phone 352-512-9191

Happy Birthday old friend!

Kevin

More Stories

Tragedy Strikes Benchmark Recovery Family – Help Needed!

Gun to the Head: Conviction in the Slidell Repossession Nightmare

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo

National Dealer Association Responds to Senate Repossession Probe

AFSA – Setting the Repossession Records Straight