Scary U.S. Auto Loan Debt Numbers Foreshadow Economic Downturn

Rising U.S. Auto Loan Debt a Symptom of Bubble Economics Permeating Society

Auto industry sales have come back from the “Great Recession” grave, but U.S. auto loan debt threatens to relegate the industry to purgatory. Rock-bottom interest rates have allowed consumers to gorge on debt for too long, setting the stage for the auto loan debt 2017 debacle playing out before our eyes. The bill has come due, and the auto industry is bracing for a protracted retrenchment.

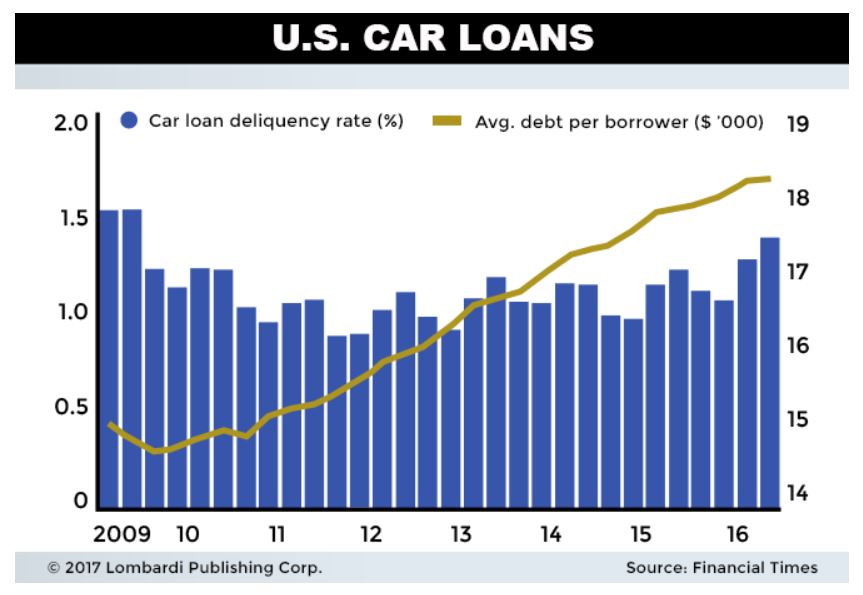

Let’s start with the fact that over one million Americans are overdue on their auto loan payments. Coupled with the fact that U.S. auto loan debt is at a record high of $1.16 trillion and delinquency rates are at their highest levels since 2009 (the “Great Recession”), and we can understand the gravity of the problem.

In fact, the Federal Reserve Bank of New York has found that 3.8% of all auto loan payments are more than 90 days in arrears. Delinquent loans have increased an amazing 38% from Q1 2016 to Q4 2016 alone. That $23.27 billion in delinquent loans is the highest such figure since the U.S. Housing crisis in 2008–2009. (Source: “Household Debt Edges Up as Auto, Credit Card, and Student Debt Climb,” Federal Reserve Bank of New York, last accessed April 11, 2017.)

This is especially problematic, since rising delinquencies are occurring despite persistently low borrowing costs and unemployment levels. This suggests that lenders may be engaging in lax credit standards to sign up borrowers who may have credit problems. The “subprime” end has been the hands-down fastest growing segment of the market. We all know how well that worked out a decade ago.

The U.S. auto loans given aren’t just for a few thousand dollars to help bridge payments from savings. In many cases, they’re the whole enchilada. Auto loan statistics suggest that the average borrower has about $18,400 in car loan debt, up 10% from three years ago. Considering that the average used car price in the U.S. was $18,600 in 2015, it can be said that Americans, on average, are financing the entire cost of their used car purchases using debt. New car prices are currently averaging $33,560, so well over half of new car purchases are being financed through borrowing. These ratios are quite high.

It’s not just U.S. auto loan debt that is showing strain. The New York Federal Reserve’s numbers also indicate that the amount of debt held by Americans rose in 2016 at the fastest pace in a decade. The totals in all main categories —including mortgages and student loans—increased around 3.8%, for an aggregate amount of $12.58 trillion nationally. This is less than one percent shy of the aggregate peak set in the third quarter of 2008, right before the U.S. housing market crisis started wreaking havoc.

The auto loan bubble is just the tip of the spear when it comes to debt, because personal vehicles are not something that Americans can easily do without. The United States is the nation which first mass-produced cars and glorified them in movies, print ads, and on the big screen. Urban planning and the mass transportation system aren’t as developed nationwide as it is in Europe or Canada. The United States has among the highest vehicle-to-citizen ratios in the world. It’s among the first indicators to show the depth of consumer credit strain, because car payments tend to be prioritized more than any other debt payment.

This U.S. auto industry crisis strain is showing up in unexpected ways, such as in the health and safety of ordinary Americans.

In mid-April 2017, a Florida woman was arrested for shooting at a repossession agent (RA) who knocked on her door to repossess her car. The victim claimed that, as he was preparing to tow away the assailant’s vehicle, the woman came to the front door with a handgun, pointed it toward him and fired one round. The victim lived to tell his story by hiding behind his tow truck as the assailant proceeded to fire again before the authorities came. (Source: “Woman charged after shots fired at repo man,” Dothan Eagle, April 18, 2017).

As the U.S. economic crash 2017 worsens and delinquencies rise further, expect more such cases in the future. Being an RA could become quite a dangerous profession.

American roads too, might become more treacherous as people press their luck by refraining from costly repairs and maintenance work. The following data is a little dated, but we’re sure that the same thing will happen when consumer spending gets pinched again.

A 2011 Consumer Reports survey found that 40% of U.S. drivers put off vehicle repair and maintenance of their primary vehicle. This, despite the fact that 44% admitted they felt that the value, safety, or reliability of the vehicle would suffer. On average, owners have logged about 78,000 miles on their vehicles, so many are approaching major maintenance milestones that shouldn’t be disregarded. There’s only one reason why consumers would choose to roll the dice with their family’s safety on the line: monetary considerations. U.S. auto loan debt, both past and present, is at the heart of this trend. (Source: “Survey: 40% Of U.S. Drivers Putting Off Vehicle Repair & Maintenance,” Consumerist, December 20, 2011.)

Perhaps more interestingly, the survey found that many drivers are choosing to hold onto their cars to squeeze more mileage out of them. Despite sales of vehicles in the U.S. (which have since peaked), many consumers simply are opting to patch up their vehicles. This trend can only accelerate as peak U.S. auto loan debt rapidly approaches.

Rising Auto Loan Debt a Major Risk for U.S. in 2017

Since the U.S. auto industry’s impressive resurgence from the near-bankruptcy of General Motors Company (NYSE:GM), it would appear on the surface that everything is fine. A record 17.55 million vehicles moved off U.S. dealer lots last year, which is a record. However, the driver has been too much consumer debt, rather than rising wage growth stemming from robust economy. The numbers bear this out.

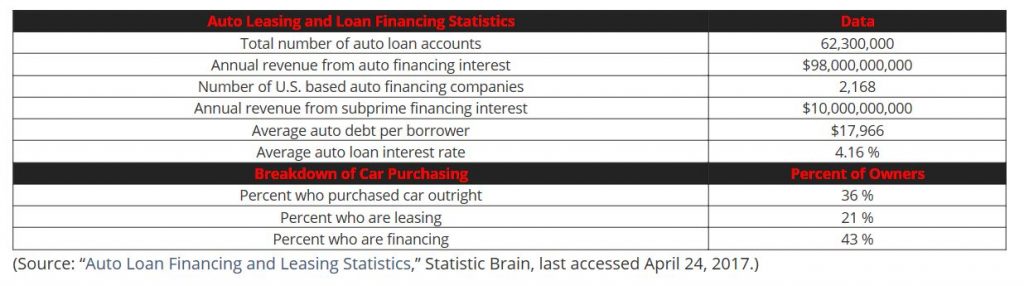

The sheer size of the U.S. auto leasing market is hard to ignore. The statistics above speak for themselves: high debt per borrower, large numbers of people dependent on loans, large amounts of money siphoned away to multinational banks in interest charges. But it’s the pace of auto loans issued which has grabbed my attention, especially from the subprime market. I’ve seen this movie before, and it doesn’t end well.

In the fourth quarter of 2016, $142.0 billion in total auto loans were issued, with $45.0 billion (32%) issued to those with low credit scores. In the subprime arena, market share has exploded. In the third quarter of 2010, loans given to those with poor credit amounted to $15.4 billion. By the fourth quarter of 2016, the number increased 77% to $27.2 billion, well above the growth rate to the rest of the industry. It seems like the main standard being used was whether one can fog a mirror, rather than creditworthiness.

Truth be told, the U.S. auto loan bubble is ultimately a symptom of the bubble mentality which permeates American society. It’s currently running parallel with the student loan, stock market, and property bubbles currently raging within the United States. The great American consumer, after decades of reliably answering the call, is starting to stagger from the corner. The shopping mentality is still present, as is the need. But they just can’t deliver with debt.

The U.S. economic crash 2017 (or beyond) will be about the debt roof caving, plain and simple. How long this roof holds is dependent upon how long interest rates stay low. Following the election of President Donald Trump, the bellwether 10-year interest rate soared past 2.6%, only to retreat in the past couple of months.

But the concerning thing is how defaults have risen sharply, with only a relatively minor increase in borrowing costs. Costs, which, by historical context, are still exceedingly low.

The Federal Funds Rate (FFR) has already been increased once this year, with experts expecting two more hikes in 2017. All this could add further pressure to interest rate increases down the pike.

As such, the auto loan bubble shouldn’t be overlooked. It isn’t on the scale of the housing market crisis a decade ago but, unless Trump’s reflation economy picks up steam soon, we can bank on a tidal wave of delinquencies. This will affect the automakers (especially their financing arms) first, with banks and auto loan companies coming in a close second.

Secondary purveyors of debt, further downstream in the chain of importance, will get hit. Credit card companies like Visa Inc (NYSE:V) and Mastercard Inc (NYSE:MA) could be impacted by “pushed out” credit card payments and outright defaults. Payday loan operators on the low end might be smashed, although pawn shops like EZCorp Inc (NASDAQ:EZPW) might have a field day.

The only people left smiling after this sad state of affairs are the repo agents, and they’re ready to snatch your car at the slightest hint of trouble.

Source: Lombardi Letter

More Stories

Westlake Clawing Back Paid Milage Fees – Agents Furious

Ode to A Repossessor – 1947

Man Gets Slap on the Wrist from Court for Endangering Repossessor

Santander Demands 20 Days Free Storage – There’s That Sucking Sound Again

2018 Annual Northeast Debt Collection Conference

Chase Pays Primeritus up to $800 on a Repo