Your spotter locates the car and informs the office. The tow truck is on the way and then, the unthinkable, your client closes the account. No, they didn’t pay current, you were the victim of a hole in the assignment process that creates countless missed repossession opportunities. Opportunities that we can save with our industry first innovation.

Ritual Rotation

Missed repossessions happen more times than anyone counts. A large part of this occurs because of lender assignment rotation strategies. As an example, in the first placement of an assignment, the agency gets the account for ten days. They pick it up or, like clockwork, the assignment goes to second placement, ten days later, rinse, wash repeat. The client knows only two statuses, it’s repossessed or its being run.

Updates are great if anyone actually reads them, but if your agent spots the vehicle and for any reason you need more time to recover it, the client will likely have no idea that a recovery is imminent. Absent that knowledge, it gets robotically closed and reassigned.

No client would knowingly waste their own time, let alone an agent’s time by closing an assignment at the cusp of recovery. The reason this problem occurs is a lack of timely and urgent communication of this imminent recovery status.

Half Communication

This lack of communication starts in the field. When a spotter or agent runs their route through Clearplan, they arrive at an address and whether they spot the vehicle or not, the current process only allows you to change the appearance of the icon to “Confirmed” or “Spotted”.

There are a multitude of reasons that could prevent an agency from securing spotted vehicles right away then “Boom”, just like that the assignment closes, and the “Confirmed” or “Spotted” icon on the map just vanishes off the agents map without a trace.

That valuable information is never stored, and if the assignment closes before the agent has the opportunity to secure the vehicle, the recovery opportunity is lost, and the agency doesn’t even notice what has been lost.

That valuable information is never stored, and if the assignment closes before the agent has the opportunity to secure the vehicle, the recovery opportunity is lost, and the agency doesn’t even notice what has been lost.

These Missed Repossession assignments can happen with voluntary and impound assignments as well as many other scenarios where mere minutes, hours or days mean the difference between a recovery or another closed account and more wasted fuel and agent time.

All of this occurs as the result of partial or only half communication. Having only periodic written and often formulaic updates, simple address run updates sent into RDN from Clearplan leaves the client unaware that the unit has been spotted and that a recovery is imminent.

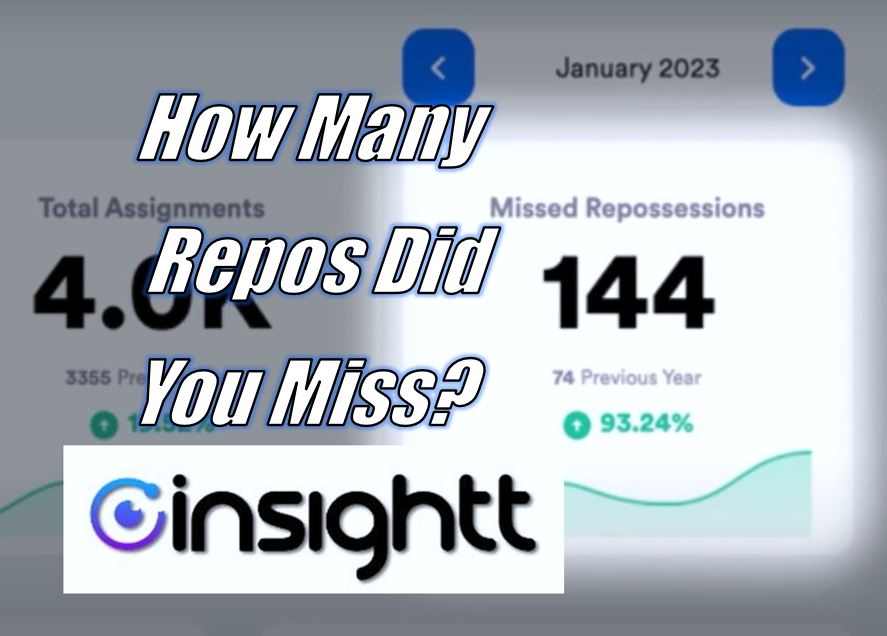

Missed Repossessions

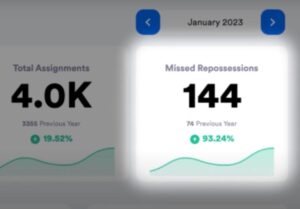

These Missed Repossessions cost agencies and the agents thousands of dollars a year and represent a massive drain on efficiency and recovery ratios. One Insightt.io Beta user showed over $300K saved in recovered vehicles that would have otherwise been Missed Repossessions.

As mentioned, it happens more than you can count, and why?

Because there is nothing in your current technology toolbox to keep that count and notify you when it happens. There is also nothing that you have that can solve this huge hole in the repossession process.

The solution to this entire problem lies in the ability to track them. This capability is the root of the solution. A first in industry solution that you will only find with Insightt.io.

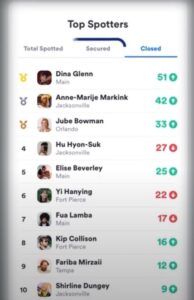

In our dashboard, we maintain a running list of every recovered and spotted assignment down to the spotter level. Every one of these spotted unit statuses attaches to the account and this is where the magic happens.

Whenever a spotted unit is placed on hold or closed, Insightt.io kicks in and automatically sends an email to the agency’s management team letting them know the account is pending hold or closed. Insightt.io has designed this preformatted email template to forward this notification directly to the client advising them that the vehicle has been spotted and requesting it be kept open.

This is critical. Your agency and employees have spent valuable time and money on this assignment and deserve the opportunity to complete the recovery.

Real Time Data, Real Time Results

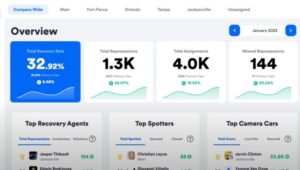

As repossession volume increases, the need to keep a firm handle on your operations becomes both critical and more difficult. You have little or no time to be running multiple reports from multiple sources to gather the information that you need to create meaningful and actionable data to effectively manage your company. And we at Insightt.io know this!

Insightt.io is a revolutionary tool that was designed and built by a repossessor. With great need comes great innovation, and Insightt.io is nothing short of that.

Insightt.io Process

All your company, client, and driver data displayed in REAL TIME – no reports to run. Ever.

- Driver Management tools that notifies you with REAL TIME alert notifications when your drivers aren’t being productive in the field.

- DRN integrations that allows you to see REAL TIME Unique Scans and Live Hits for every driver.

- See where each type of driver ranks amongst the same driver type so you can easily identify problematic employees.

One central app for ALL analytics, timeclock, and employee management.

Reports

Tired of constantly running a million different reports to get the information you need to run a successful operation? We are too! Insightt.io is designed to give you all of your company, driver, and client data for all of your locations, all in REAL TIME! If you wait on a scorecard to see where you stand, it’s already too late. Reports data includes:

- Companywide recovery rate as well as each individual branch in REAL TIME.

- REAL TIME recovery rate for every client, for every location.

- MTD/YTD repossessions – MTD/YTD assignment count – MTD/YTD missed repossessions – MTD/YTD recovery rate – MTD/YTD driver leaderboard – MTD/YTD employee stats

Client Details

The Client Detail page allows you to see your REAL TIME MTD/YTD numbers for each client, for each location in comparison to the same time period the year before. Set recovery rate goals for each client and see your REAL TIME scorecard come to life for every client, for every location.

Client Details also displays each client’s assignments, repossessions, and recovery rate data for the past 4 years so you can easily identify which client(s) are the most profitable and which client’s volume is increasing/decreasing.

Industry Firsts

From being able to see spotter and camera car performance data, to being able to see and identifying all missed repossessions, to being able to see a REAL TIME scorecard for every single client, Insightt.io is filled with Industry First’s.

More Stories

Repo Alliance – This Week in Washington – March 2026

Royal Key Supply Announces Kevin Zwahlen as Account Executive – Repossession Sector

CALR Meets with State Repossession Regulators

Powering Smarter Recoveries, Vendor Safety and Faster Workflows

Take the Survey: Tell RDN What Recovery Pros Need Most

One Year Later: How Real-Time Communication Is Keeping Recovery Agents Safer