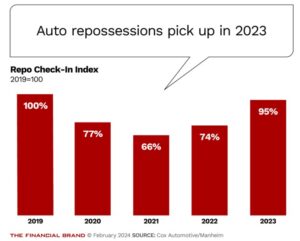

For most agencies, repossession volume in 2024 was at levels not seen in many years. But just how high were they and why? Furthermore, what lies ahead for repossession volume in 2025?

Now that we have 2024 behind us, we get to look back at numerous data points to give us some perspective on just how heavy the repossession volume in 2024 was. While there is no one data source that captures all of this, there are some reliable industry data sources that we can use to get a better picture.

Repossessions in 2024

According to data from Cox Automotive as reported by Yahoo, in 2024, car and truck repossessions increased by 23% compared to the same period in the previous year. Their report indicates that this surge means that repossession volume in 2024 was approximately 14% higher than the first half of 2019.

While specific numbers for the total count of repossessions for the entire year of 2024 are not explicitly provided in the available information. It is estimated that approximately 1.5 million vehicles were repossessed in 2023. Considering the quoted 23% increase, one could estimate that around 1.85 million vehicles might have been repossessed in 2024, assuming a consistent rate of increase throughout the year.

Please note, this estimate is based solely on the following available data and trends:

- 23% increase from 2023 to 2024

- Comparison to 2019 levels

Repossessions in 2025

Looking forward to 2025, the volume of auto loan repossessions is expected to stabilize or even show a slight decrease from current levels. Regardless, this would still be at or below historical norms. Here’s a detailed look based on recent trends and analyses:

- Current Trends and Projections

Analysts have noted that while there we have seen a significant increase in auto loan delinquencies and repossessions in the post pandemic world, these are expected to normalize.

Cox Automotive predicted that through 2025, the trends in defaults and repossessions would either remain at current levels or decrease slightly, reflecting a stabilization in consumer financial behavior and economic recovery.

This suggests that repossession agencies might not see a significant surge in volume but rather a continuation of the current pace or a slight downturn.

- Economic Factors

The economic environment plays a crucial role. Inflation rates, unemployment levels, and consumer debt levels can influence repossession volumes. As of recent reports, with inflation possibly moderating and unemployment remaining relatively low, these factors could lead to a scenario where repossession volumes do not spike, assuming no unforeseen economic downturns occur.

- Loan Performance:

According to The Financial Brand, the performance of loans issued during the peak of economic uncertainty (2021-2023) has been under scrutiny. Loans from these vintages have shown higher delinquency rates due to higher car prices that rose from an average of about $30,400 in 2019 to about $38,761 by 2024.

However, if these loans mature or are refinanced under potentially better economic conditions, the pressure on repossession volumes might ease. Especially if interest rates fall or stabilize, allowing for easier payment management by consumers.

This is of course offset by the disturbing trends in auto lending in Q3 of 2024. In Q3 of 24′ the average negative equity on trade in’s rose to an all-time high of $6,458 per sale. This affects underwriting and creates a barrier to refinancing due to loan to value limitations.

- Market Adjustments

The automotive market has seen adjustments with car prices falling from their peak during the supply chain disruptions. This normalization could mean that fewer new loans will be underwater, reducing the likelihood of repossession for newer vehicles. Nonetheless, older loans from when prices were higher might still contribute to repossessions if borrowers cannot keep up with their payments.

- Consumer Behavior and Support

Consumer behavior, influenced by government support measures like stimulus checks and forbearance programs, has also impacted repossession rates. Many of these programs create a flood of “extend and pretend” scenarios where lenders are not reporting delinquencies in a manner truer to the actual risks.

With such measures winding down, the natural expectation would be an increase in repossessions, but the trend has been towards stabilization, indicating that consumers might be adjusting their financial planning. But the question is, are lenders being deceptive in their reporting in hoping to avoid repossessions through loan modifications?

2025 Repossession Volume Forecasts

Overall, while repossession agencies might not experience a boom in 2025, they are likely to deal with a steady volume of repossessions, which could be slightly less than recent years, reflecting a return to more predictable economic conditions and consumer behavior patterns. These projections, however, hinge on continued economic stability and no major disruptions in the auto finance market.

Based on projections from Cox Automotive, the volume of car and truck repossessions in 2025 is expected to rise or hold near steady at approximately 1.8 million vehicles. This figure would still represent levels not seen since 2019, suggesting a return to or slightly above historical norms after a period the dramatic fluctuations caused by the pandemic of 2020.

Despite such moderate forecasts, there are some who suggest that the swell of repossession activity will rise. Some even suggest they could rise to as high as 2.1 million to potentially 2.25 million. These figures should be treated with caution as they stem from social media speculation rather than actual official data.

Looking Into The Crystal Ball

Even with all of the data and expertise of industry auto finance experts like Cox Automotive, much of this is speculation. Given what limited knowledge of what the future holds for us and all the variables that lie ahead, drilling down on the data is about as good as anyone can do.

Remember what little we knew of what was coming our way this time in 2020. Now look at the national and global climate that we are staring down the barrel of and you can easily see the numerous variables in the economic environment that could affect any form of normalcy and toss any forecast to the rocky shore of fate. Only time will tell.

Kevin Armstrong

Publisher

More Stories

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo

National Dealer Association Responds to Senate Repossession Probe

AFSA – Setting the Repossession Records Straight

Borrower Gets Two Life Sentences for Shooting Repossessor

Gunfire During Texas Repo Caught on Video