Exploring the numbers

Like vultures in the lurch, the repossession industry sits in wait for any economic sign that might foretell an end to the two-and-a-half-year repossession drought. So, when headlines splash across the news of an “explosion” in repossessions, everyone gets excited. Unfortunately, this was all “click-bait” with no statistical basis. But, doing a deep dive into the Fed’s data, there are encouraging signs for the industry, but not so much for the economy.

Last week, Wolf Richter of WolfStreet, wrote an article titled “Nope, Auto-Loan Delinquencies and Repos Are Not “Exploding”: They Rose from Record Lows and Are Still Historically Low”, in which he correctly snuffed the earlier mentioned click-bait headline stories of the mythical explosion in repossessions.

Richter approached the issue from a simple cradle to grave snap shot of auto delinquency as reported by the New York Fed’s Household Debt and Credit Report. In exploring the presence of repossessions, he pointed out the historical delinquency levels of where we are now compared to 19 years of delinquency reporting and found what we all knew all along. There was no significant increase in delinquency that would foretell an increase in repossessions.

Download the Data Here!

What the data does say

So, I dug in a little deeper and downloaded the Fed’s data and did manage to find some interesting trends which I charted out on my own to provide some historical perspective.

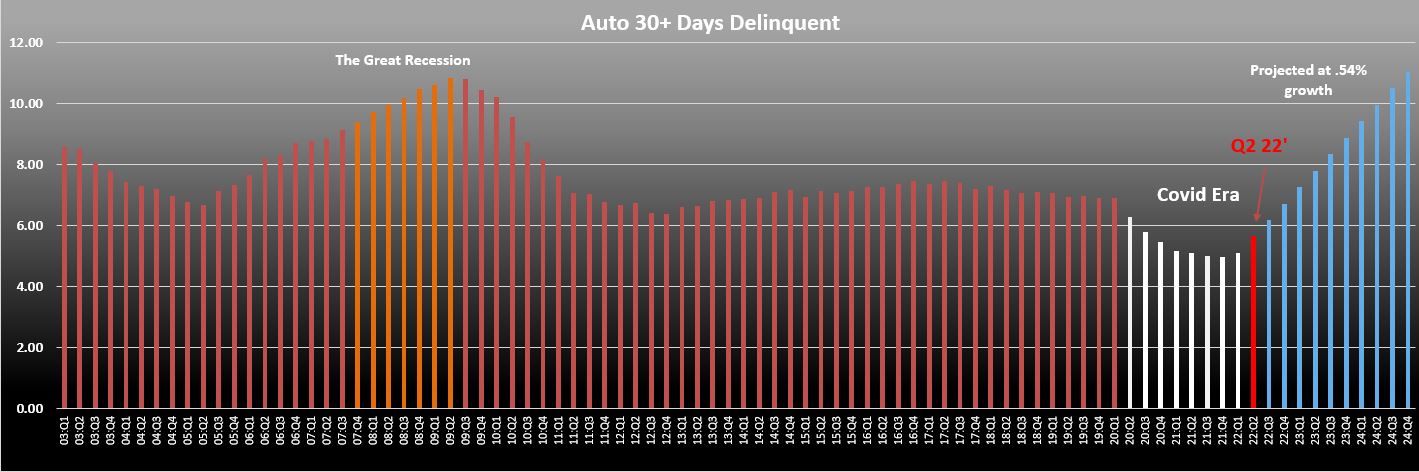

Starting with 30-day delinquency, the true harbinger of rises in delinquency, I found that;

- Obviously, delinquency is still not at pre-pandemic levels. In fact, at 5.64%, it’s only slightly more than half what it was during the Great Recession and 1.2% below where it was before the pandemic.

- But what is of note, is the month over month increases of the past two quarters. Q1 of 2022 showed the first increase in 30-day delinquency in nine quarters with a modest increase of .14%. Progress, but nothing to get too excited about.

- What is interesting though, is that the increase between Q1 and Q2 of 2022, showed an increase of .54%. This is the largest one quarter increase in 30-day delinquency since Q2 of 2006, which was a year and a half before the official start of The Great Recession when delinquency had climbed at an average rate of .18% per quarter leading up to it.

While significant, even if it maintained a .54% quarterly growth average, it wouldn’t be until Q1 of 2023 until this delinquency point returned to pre-pandemic levels. In order to reach Great Recession levels, it wouldn’t get there until Q3 of 2024. So unless there are record high sustained increases in 30 day delinquency over a one year period, this could be a slow crawl back to normalcy, whatever that even looks like anymore.

90 days, the repo bucket

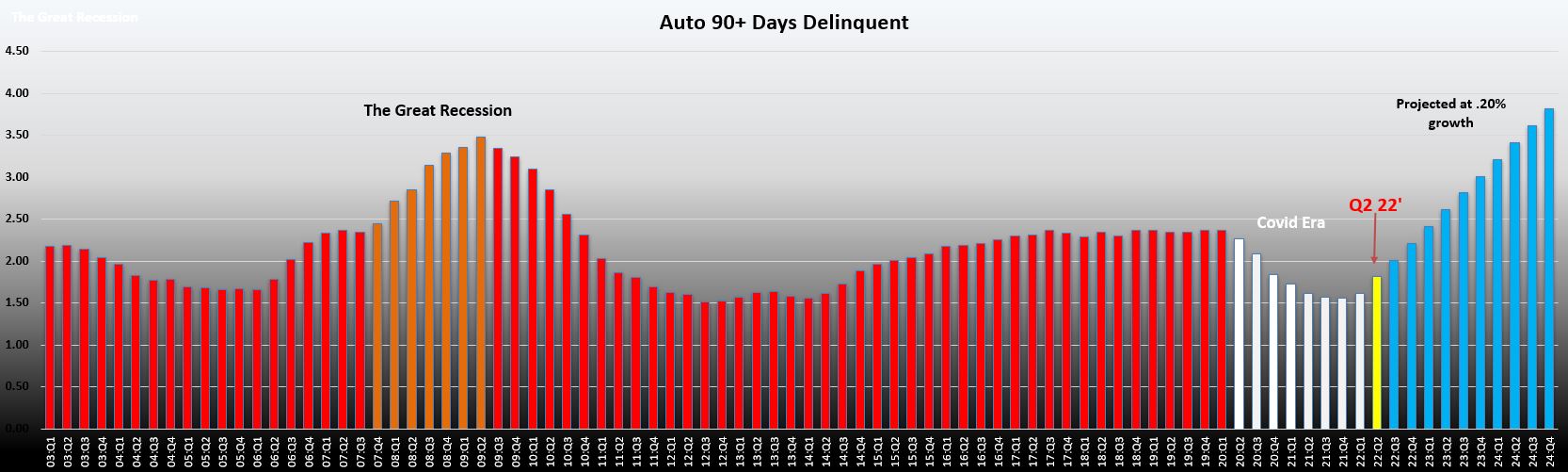

90 days delinquent, 4 payments past due. The repossession assignment sweet spot for most lenders. Odd enough, the 90-day delinquency data paints a more encouraging picture for the industry. 90+ day delinquent auto loans reached 1.81% in Q2 2022. A similar level to the declining post Great Recession delinquency numbers of Q4 of 2014, but again, one data point does stand out.

While Q1 showed the first increase in delinquency in this tranche since before the pandemic, it is Q2 that showed a spike. With a .20% increase, it is not the largest increase on record, but is significant in that it is the highest since the Great Recession and the two years leading up to it.

This spike would indicate that there had been in Q2 some increases in repossession activity. While the volume of this activity would be more resembling the 2011 to 2014 era, it matches much of what the industry has been saying; “It’s up, but not booming.” or, “It’s near pre-pandemic levels.

What’s next?

That is the million-dollar question. There are so many variables.

- Rising interest rates – This could affect the sales and auto refinance market. Rising interest rates can cool the economy and inflation, but of course at the cost of funds for capital. Capital used to grow businesses and sustain large dollar item purchases.

- Gas prices – We’ve seen some easing in gas prices, but it is still too high. This may help soften some of the other effects of inflation and reduce pressure on consumers and slow the rise in serious delinquency.

- Inflation – July’s CPI inflation report will be interesting. If there is no considerable reduction in the inflation rate, the financial strain on the public will continue to endure. This is one element that when played against the next, is like a match and kerosene.

- Employment – While the White House does victory laps over the recent jobs report that over 500K new jobs were created, it may be a bit premature. What kind of jobs are these? Unless the jobs being created are well paying jobs that show payroll increases at or better than the inflation rate, they’re almost meaningless.

- Layoffs – Here in Silicon Valley, there have been a lot of layoffs and downsizing. The same holds true in many other job markets. These are well paying jobs whose holders can sustain a recession, unlike the service industry jobs that barely make enough to pay rent and often require a person to hold more than one of to keep their heads above water.

Don’t hold your breath

It is undeniable that the American economy is in a major slump, if not heading into a full-blown recession. But not all recessions are the same. The conventional wisdom in collections before the Great Recession was that there was a payment priority that people maintained. House, car and credit cards was the order in which credit payments were traditionally paid.

During the Great Recession, largely driven by a real estate meltdown, that order became reversed. People were walking away from their homes, keeping their cars longer and maintaining their credit cards to live off of until loading them up before filing for bankruptcy. So, what are we in for this time?

Well, if you look at the red-hot real estate market leading up to the Great Recession, you can see what may be a glimpse of the future. Much like real estate, that took a nosedive when people started walking away from their homes, the same could hold true of the auto market.

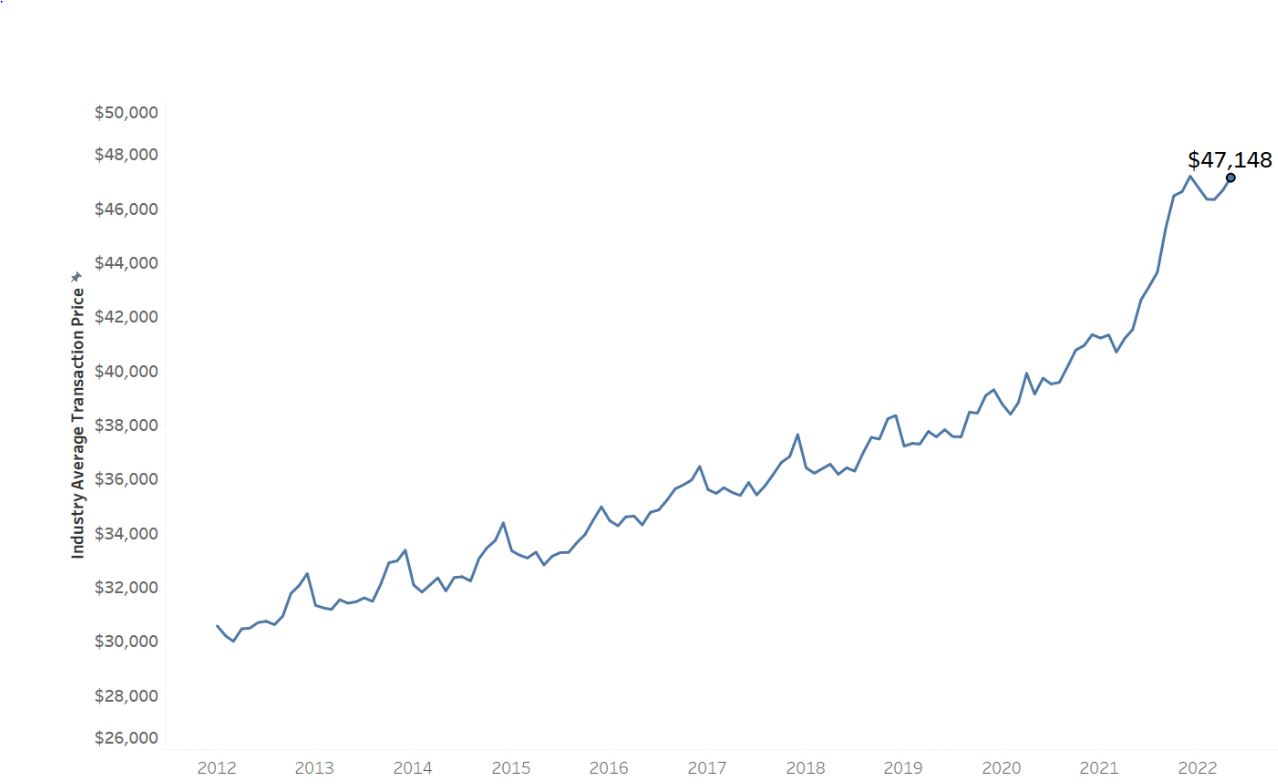

The auto market has been booming. Not so much in volume, but in prices. Blame inflation and gas prices if you will, rising interest rates and limited supplies have created a sellers-market and the dealers are really sticking it to people

Year over year, the average cost of a new has gone from $42,380 in 2021 to $47,148 and the average car payment has risen from $639 in Q4 of 2021 to $644 by Q2 2022. As you can see from the minimal increase in payment vs balance, consumers are choosing increasingly longer terms, indicating a greater payment sensitivity.

Are these inflated prices creating a valuation bubble? They very well could and if people start feeling ripped off, like they did during the Great Recession, we could see a return of borrowers just dumping off the keys with lenders, just as they did fourteen years ago. Sudden and heavy increases in repossession volume could deflate wholesale values, increase losses and start that same viscous circle all over again.

Is it inevitable? Not really. The economy is definitely stressed, but it could take a long time for serious delinquency to develop, or not. As we’ve all seen over the past two-and-a-half years, anything is possible, so we’ll all just need to sit back and watch as it slowly develops.

My guess? Second Quarter 2023.

Kevin

More Stories

Rising Fuel Costs Are Impacting Repossession Operations

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most