A Letter from the President of the American Recovery Association, Dave Kennedy:

It is old news that as an industry we are putting ourselves out of business. We are going to cause a disruption in our own lives and the industry based on:

- Our inability to unify, work together and take a stand

- The “me” mentality

- The idea we know everything and don’t need anyone to tell us

- The “I will make it up in volume theory”

- Ignorance of the facts

This industry has refused to learn, for the most part. We have placed our businesses on the fast track to “OUT OF BUSINESS.” Once and for all, here are the facts.

These facts are based on figures received from Harding Brooks Insurance Company representing the Average Repossession company has 5-7 trucks and 10-14 employees.

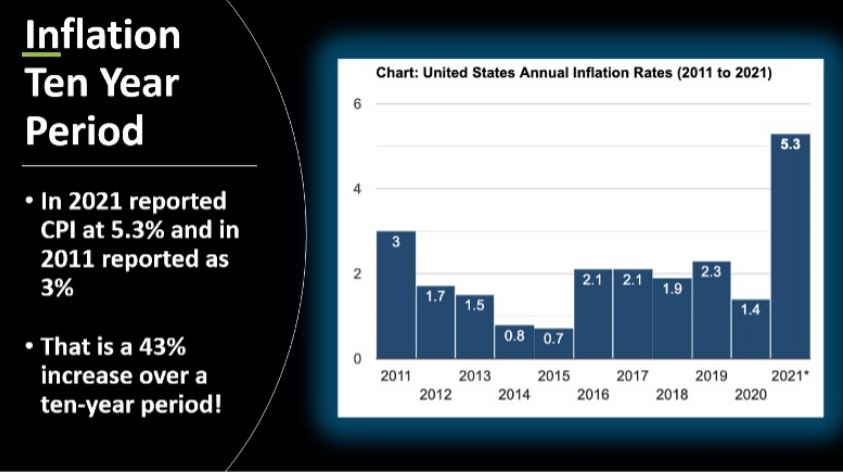

As an average, we have seen a 28.92 % increase in fuel costs over the last three weeks using $3.25 as the starting point and $4.19 as the ending point which is the average cost of fuel today in Pennsylvania. My trucks are paying that figure today at the pump. Even before this last round of price increases the industry had on average a 17% increase in fuel expenses.

Over the last 5 years, an average company has seen a 45.65 percentage of increase in insurance costs. I have had no reportable accidents in 7 years and my cost has gone from $46,000.00 to $67,000.00 this year.

Over the last three years, maintenance for the average company has risen 18%. Five years ago, the figure of $800.00 -$1,000.00 was used per month per truck. Not every month but by the end of the year that’s what it cost; some months less, some months more. Today the figure is $944.00 to $1180.00.

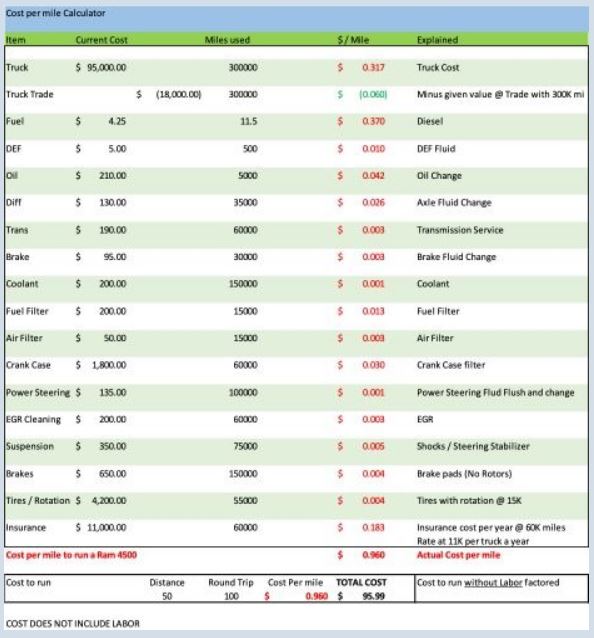

As you can see the cost to run an F450 wrecker is 95.99 cents a mile or $95.99 dollars for every 100 miles. It is not unusual for a truck to average 50-60 thousand miles per year. This equals $57,795.00 in operational costs per truck. I have eleven trucks or $580,740 in just truck costs. This does not include the cost of labor. With the projected increases in fuel, shortage of and increase in automotive parts I will need this year, the figure could jump to 92.6 cents per mile.

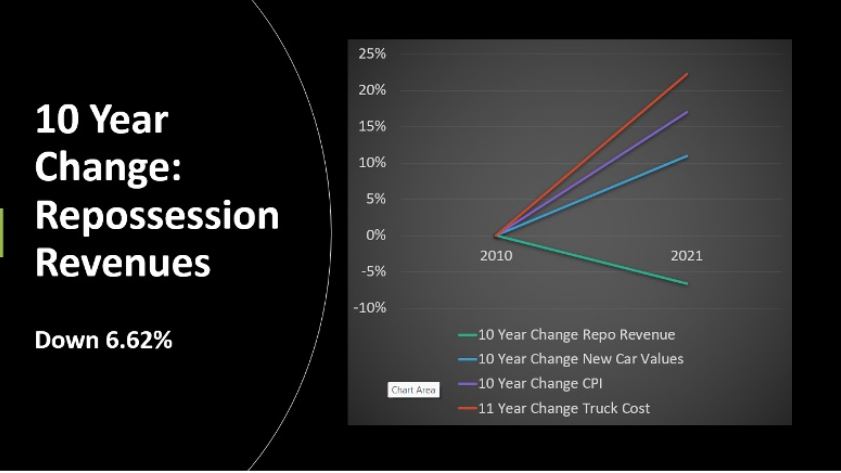

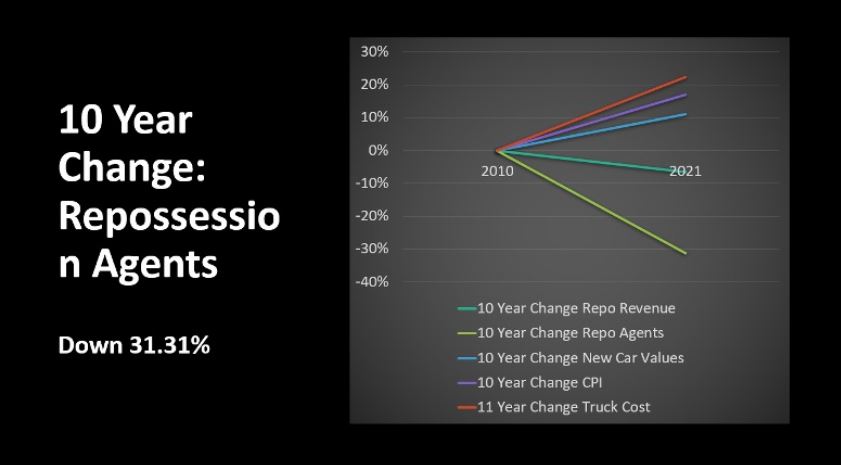

At Used Car Week through the cooperation of St. Joseph’s University, International Recovery Systems (IRS) presented a study on the sustainability of the repossession industry based on revenues only in their core business of repossessions. Under the current average pricing, here are their findings:

As you can see the results are a resounding NO. Agents, if you are providing ancillary services and showing a profit on them such as Keys, Transport, Lot Sweeps, you cannot say your repossession side is profitable. At $325.00 or $350.00 it is NOT. You either don’t know your numbers or you are taking into account other revenue streams.

These are the effects of us allowing contracts to be forced on us and letting fear or the fact that, if we say no, most will close their doors in 60 days. Florida licensed agent base is down 23%. In California, at the time of this report, 67 agencies closed their doors. We cannot afford to hire and retain staff; we cannot afford to invest in our companies because we are using every penny just to keep the doors open.

International Recovery Systems and St. Joseph’s University have made it very clear. LENDERS, you are lending money on autos at record levels, the amount of the loan is at an all-time high, the term of the loan is at an all-time high. Detroit has not improved their product to keep up with 10-year loan terms. Are you willing to watch your agent base disintegrate right before your eyes?

The issue is not just fuel and truck costs. It is the idea that we are forced to utilize software and compliance training programs at exorbitant costs! We must utilize many different forms, policies and procedures that could be standardized, i.e., condition reports, release, and transport forms. This should not be a “higher fees are the only solution” discussion.

I write this as an educational piece and encourage the stakeholders in this industry to begin a serious discussion on how we build a profitable and sustainable business model that benefits all sectors. We will be co-hosting a roundtable discussion that will include representatives from all sectors of our industry in April.

Dave Kennedy,

Dave Kennedy,

From the ARA President – Putting ourselves out of business – ARA – American Recovery Association –

From the ARA President – Putting ourselves out of business –

More Stories

Colorado Bill Aims to Severely Impact All Repossession Operations

Take the Survey: Tell RDN What Recovery Pros Need Most

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Winter Storm Serves as Wake-Up Call for Repossession Industry Preparedness

American Recovery Association Urges Industry-Wide Action Against Municipal “Pay-to-Play” Repossession Ordinances