Agency owners banding together for higher fees

EDITORIAL

Repossession volume has been slowly increasing, but with it has come record high inflation and gas prices. But still, repossession fees are stagnant and what improvements are being offered, are paltry in comparison to where they should be. Now a series of repossession agency owners had decided they’d had enough and are blacking out the forwarding industry from coverage in the state with the third highest repossession volume in the nation.

The Shut Down

In what is probably the first time in the history of the repossession industry, a group of agency owners have launched a shutdown in protest. Almost two-dozen Florida based repossession agency owners banded together and turned off their LPR cameras in protest last summer. Some went as far as laying off their camera car staff and have kept their cameras off permanently. Approached by their vendors with offers of improved fees, some resumed their work. But many are keeping their cameras off until more realistic fees are offered.

While they lost revenue, they felt it a worthy sacrifice to prove their point. Now they have taken aim at the forwarding industry.

According to sources, by declining assignments, they have virtually shut forwarding companies out of the Ft. Myers market and weakened their operations across the state. Primeritus has reportedly pleaded with them to resume operations but offered nothing substantial in fee increases in return while PAR has asked them to “just give them a little time”. As such, most forwarders are reportedly incapable of providing recovery services in large portions of what is the nations third largest repossession market.

Their Demands

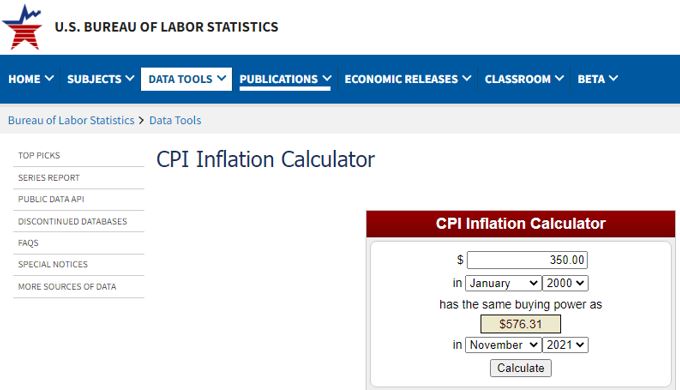

So, what do they want? According to sources, they are demanding $600 per recovery. Sound crazy? Well, it’s not. Take a look at the Consumer Price Index Calculator provided by the US Bureau of Labor Statistics.

Type in a repossession fee of $350 using the back date of January 2000. Now choose the most recent period of their calculator, November 2021. It comes back with $576.31. That is exactly what a repossession fee looked like in 2000 and accounting for increased operational expenses and the value of currency, that is what the fee should look like in 2021.

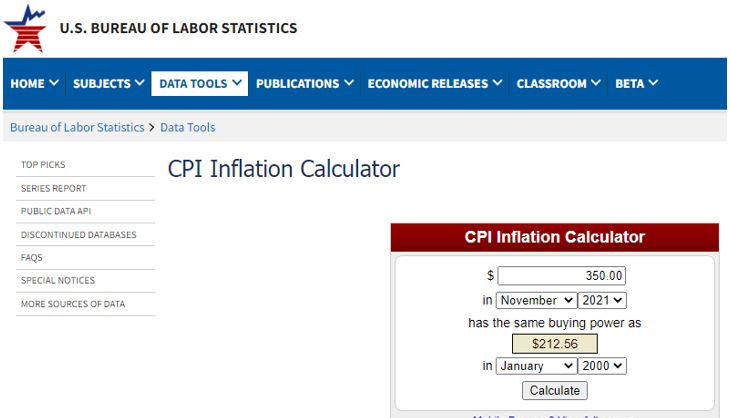

If you look at it the other way around, if you were making $350 for a repo in 2000 and are still only making the same, that $350 is now only worth $212.56! Let that sink in, the spending power of the dollar has gone down almost 40%, yet they keep wasting time and money chasing a failing business model and it only worsens by the year. But on the bright side, someone is making out like thief, the lenders are paying a comparable 40% less than they were over twenty years ago!

If that doesn’t make your blood boil, remember that inflation has only gotten worse since November, so even that is a conservative number. Remember that in 2000, repossession agencies, for the most, were still able to collect personal property fees and some semblance of storage fees and keys. That said, you can see that $600 is not at all off the mark. It’s been five years since I wrote the editorial “The $500 Repo Fee” and it’s only gotten worse.

Somehow, everyone seems to forget all of the risk and liability that the agency owners and their staff encounter on a daily basis. Agents encounter assaults and shootings that often lead to injuries, short and long term as well as deaths that occur on an annual basis. These people deserve wages and benefits equal to the degree of risk that they encounter while representing the nations largest lenders and that is not going to happen for $350 a repossession.

The idea that any professional in any other industry would work for the same fees now as they did twenty years is laughable. Show me another service that costs the same now as it did in 2000, I dare you.

Price Fixing?

Now, when a group of business owners band together to attempt to control prices, accusations of price fixing and anti-trust violations are sure to follow, right or wrong, I am not a lawyer and am not to say. Way back in 1981 this accusation was made against the, then, four national repossession associations and resulted in the DOJ sanctioning them, fining them and essentially neutering them from even discussing the issue publicly. Without the associations being able to suggest fees to address inflation and operational expenses, the following decades became an “every man for themselves” industry that the lenders have exploited to such a degree that repossession fees, to the dollar amount, are basically the same as they were in the 1990’s.

So, how is it that lenders and forwarders have done this with impunity and it’s not called price fixing? Simple, it’s not. They have the right to state what they will pay for a service, just like anyone else. Likewise, every service provider has a right to refuse to provide those services for fees below their chosen price.

The repossession forwarding industry has a stranglehold over the vast majority of repossession volume assignments across the country. It is maintained by keeping a large pools of agencies willing to work for these outdated fees. If an agency quits working for them, they still have several in most areas that will accept them, all the while unknowing that another agency or agencies are declining to work those fees. The fowarders in turn, are able hold the fee line low and continue to pitch to the lenders these 1990 fees.

A large part of the problem lies with an age-old industry self-esteem issue and an oddly victim like fear of that “If I don’t do it, someone else will.” In short, the lenders have been getting away with it because too many of the seemingly A-Type personality agency owners let them. They even go as far as claiming that their making good money, when in reality they simply doing what they are told and purposefully ignoring the facts that as inflation grows, they are getting paid less, year by year. Let’s face it, the agency owners have been ignoring the writing on the wall and letting this happen to them.

Even as a layman, it is obvious to me that if an agency owner turned off their cameras or refused to accept forwarding work unless they were paid a set wage that it is not price fixing or an anti-trust crime. However, when a group of agency owners band together to do so, that is a whole different issue. To the best of my knowledge, this is not being orchestrated by an association and is merely an informal group of like-minded company owners. Regardless, they seem to have caught the attention of others.

These agency owners aren’t some whiney Starbucks barista’s joining “The Great Resignation.” This is a much larger and serious issue. An issue that has been ignored far too long and without dramatic action, nothing will only get worse.

A Growing Movement

Will the remaining banded Florida repo agency owners make an impact? Hard to say, but there is strength in numbers and the longer they hold together, the better their chances. Rumor has it that likeminded agencies in the next largest markets of Texas, California and elsewhere are talking. How much impact is really being done in Florida is unknown, but if it spreads to other states for a prolonged period, it could show results.

Could those result in a $600 repo fee? Probably not without a massive forwarder blackout in the largest states lasting months. Legal or not, I don’t know but personally, I applaud their effort. The only leverage the repossession industry has against the lender and forwarder imposed flat fee environment is the power to say “NO!”

Kevin Armstrong

Editor

Florida, the beginning of the “Great Repo Resignation”? – Florida, the beginning of the “Great Repo Resignation”? – Florida, the beginning of the “Great Repo Resignation”? Florida, the beginning of the “Great Repo Resignation”? Florida, the beginning of the “Great Repo Resignation”?

More Stories

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control