Introduction

First, I would like to thank everyone who participated in this survey and we hope that it provides a snapshot of where the industry currently is and where it may be heading. It had been over 8 years since we have conducted a “State of the Repossession Industry Survey” and under the circumstances of the national crisis and localized moratoriums on repossessions, many agency owners are facing new challenges that were just a few months ago, unimaginable. With that in mind, we crafted some questions to address how agency owners may be coping with these new issues.

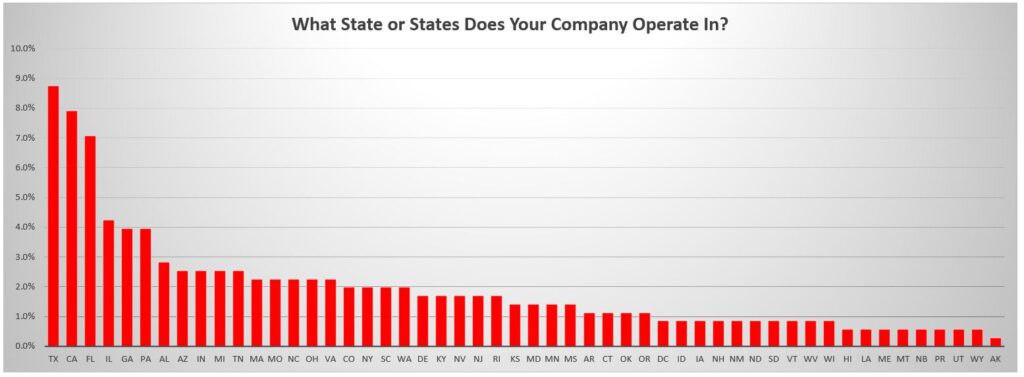

Caveat; Any valid survey is dependent upon strong data quality. This was an informal survey and none of the respondents were vetted, however, we were in contact with many agency owners after the fact and feel strongly that they did put their best foot forward. With over 226 respondents, we were able to develop some reasonably strong data, especially in the states of Florida, Texas and California, where over 30 agencies participated.

Respondents

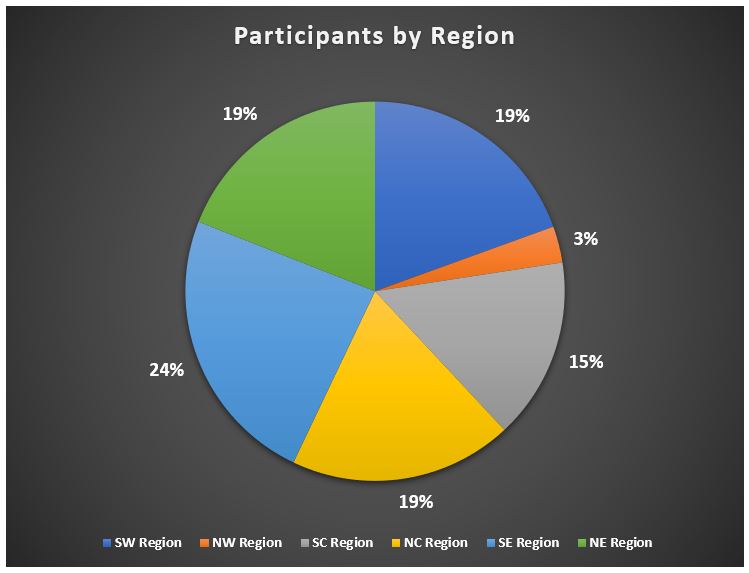

As well as looking at the data at the national level, we took advantage of the larger data pools in some areas to absorb those of states with less respondents as regions and bifurcated the data into six regions;

- South West Region – CA, NV, AZ, NM, UT, CO, HI

- North West Region – WA, OR, ID, MT

- South Central Region – TX, OK, AR, LA

- North Central Region – IL, IN, IA, KS, NB, MI, MN, MO, ND, SD, WI, OH

- South East Region – FL, GA, AL, SC, KY, TN, MS, NC, SC,

- North East Region – CT, DC, DE, MA, ME, NH, NY, NJ, PA, RI, VA, WV

Due to the varying populations in these areas, the North West Region had poor participation and could almost be seen as an outlier to the rest of the regions, which were reasonably close in size. Overall, 43 of the respondents operated in two or more states and those companies results are contained within each applicable region. Alaska had no respondents.

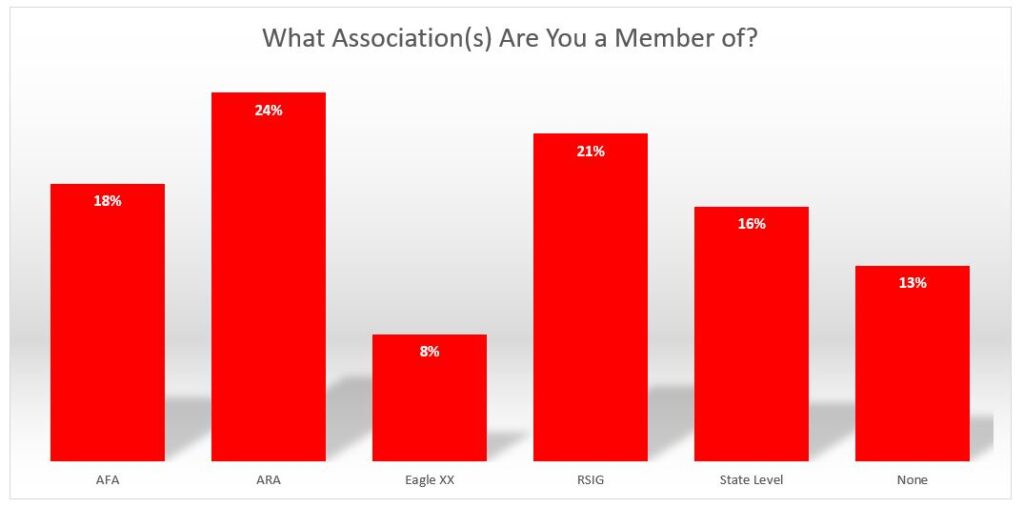

As expected, the respondents came from all of the state and national associations.

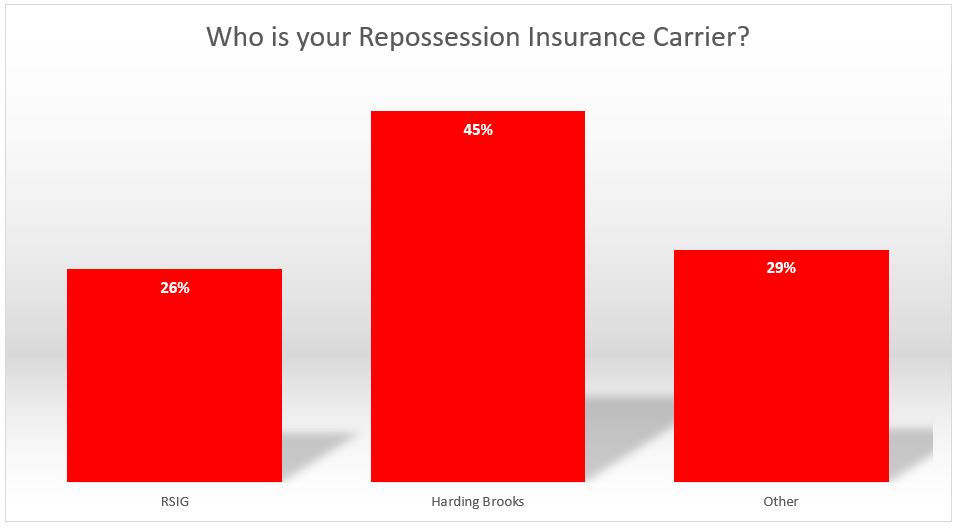

Harding Brooks repossession insurance showed the largest number of respondents, but in my haste to get the survey out, I failed to include ATIG and Walt Cagley Insurance companies as additional choices.

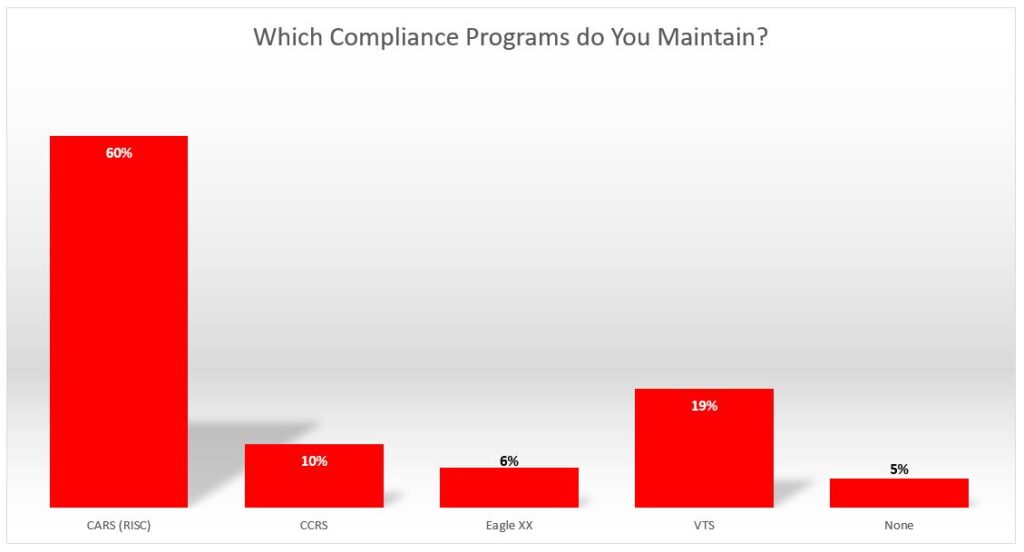

CARS was the largest compliance vendor chosen by a landslide at 60% of all responses.

Facebook Comments