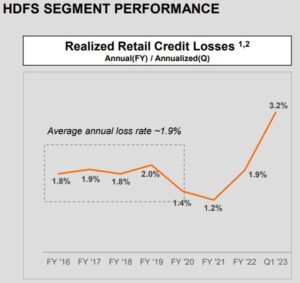

And the blame game begins. It is no surprise to the repossession industry that COVID drove away a large number of repossession agencies. It is also no surprise to the industry that at some point lenders were going to suffer from it. Of all the lenders, Harley-Davidson appears to be the first to publicly address this growing problem.

On Thursday the 27th, Harley-Davidson Inc., financial arm, vice president and treasurer David Viney said on an investor conference call that their credit losses in the first quarter were due in part to a shortage of repossession agents.

According to an article from Bloomberg, Milwaukee-based Harley, a lack of repossessions combined with a decline in retail bike values contributed to credit losses of about $52.6 million in the first quarter of 2023.

According to an article from Bloomberg, Milwaukee-based Harley, a lack of repossessions combined with a decline in retail bike values contributed to credit losses of about $52.6 million in the first quarter of 2023.

“A lot of people left the repossession industry during Covid,” Viney said.

Viney added that Harley has accelerated efforts to reach customers in cases of late-stage delinquencies, and that the company is “making a lot of enhancements” to its repossession strategy. Those changes, combined with an expected seasonal recovery in credit losses, should help reduce the loss rate in the coming quarters, he added.

Estimates vary, but most industry leaders agree that anywhere from 20% to 30% of the repossession agencies that existed before the pandemic closed during those lean years. Of those remaining, a greater number are demanding higher fees and are declining assignments from those who refuse.

Prior to COVID, lenders had enjoyed stagnant repossession fees ranging from $275 to $350 per recovery and contingent. These numbers remained unchanged for over 30 years.

The prior high number of repossession agencies had created a market so competitive that agencies who desired to increase their wages, found few if any lenders willing to accept the fact that inflation was affecting them like everyone else. This flat rate environment left most agencies with little or no financial reserves beyond those offered through PPP loans to remain in operation.

As the result, the pool of professional repossession agencies and agents has created greater demand on those remaining. While Harley-Davidson complains that they can’t find agents to recovery their defaulted loan collateral, a large part of the problem may lie in the fees they are willing to pay.

Harley, from what I’ve been told, is not only contingent, but like the rest of the lending world, has been spoiled by pre-COVID, l stagnant repossession fees ranging from $275 to $350 per recovery and contingent. These numbers remained unchanged for over 30 years. But those days are coming to an end.

Motorcycle repossessions are time-consuming and require almost entirely voluntary cooperation from the borrowers. Let’s face it, not many people leave their Harley parked out on driveway, curb or your average apartment complex carport.

It is no coincidence that the head of collections and recovery for Harley-Davidson met with Vaughn Clemmons, President of the ARA on Monday. They appear to be more than painfully aware of their deficient pay practices and have proposed; $300 repo fee, $200 fuel fee and a $150 flatbed fee for an average of $600 per recovery.

Sounds great, right? Wrong, it’s still contingent and carries single digit recovery ratios. Facts that Vaughn advised me that he felt compelled to remind them.

The fact that Harley made mention of this in their investor meeting has already caught the attention of the Wall Street Journal who are following up on this story and have conducted interviews with Vaughn and Jeremy Cross. Vaughn has told me that they are pushing back against their narrative and will be highlighting the issue of fees as being the largest contributor to their losses rather than the lack of agencies.

Harley’s complaint of being unable to find agents to recover their work is likely to become a common refrain in the coming months and may reach it’s crescendo by this summer when delinquency traditionally spikes and the lingering effects of inflation and growing layoffs kick in.

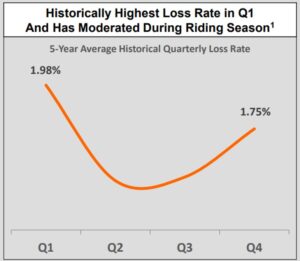

In Harley’s slide show, they assert that Historically Highest Loss Rate in Q1, based on a five-year average and that it “Has Moderated During Riding Season.” This may be true, but they don’t seem to be accounting for the very high probability that we could be in a recession by then and when push comes to shove between bill priorities, the bike and other toys tend to get kicked to the curb.

In Harley’s slide show, they assert that Historically Highest Loss Rate in Q1, based on a five-year average and that it “Has Moderated During Riding Season.” This may be true, but they don’t seem to be accounting for the very high probability that we could be in a recession by then and when push comes to shove between bill priorities, the bike and other toys tend to get kicked to the curb.

It will be interesting to see who the next lender to publicly air this complaint is. It could become the “dog ate my homework” excuse from many a lender in the months to come.

You get what you pay for. Just sayin…

Kevin

More Stories

A Repo, Gun Threats, Hidden Meth, and a Felon’s Desperate Hideout

ATR Driver Critically Injured in Semi Collision – Needs Help!

Tragedy Strikes Benchmark Recovery Family – Help Needed!

Gun to the Head: Conviction in the Slidell Repossession Nightmare

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo