“Systems and Methods to Repossess a Vehicle.”

I’m sure that by now many, if not most of you, have already read one of the numerous articles about Ford’s patent filing for remote automated repossessing titled “Systems and Methods to Repossess a Vehicle.” Pretty exciting stuff! What could go wrong, right?

We’ve all known this is coming. Tesla has already allegedly been employing some of their remote features to assist repossessions in the field for some time now. But they hadn’t ever, nor any other automaker to my knowledge, gone as far as Ford, who has just applied for a patent for the first known “Systems and Methods to Repossess a Vehicle.”

It’s pretty clear that this wasn’t some 3am I’ve got a wild idea brainstorm scribbled down on napkin in the kitchen. Ford’s notion of developing autonomous “Systems and Methods to Repossess a Vehicle” was initially submitted to the United States Patent Office in August of 2021.

Formally published last week on February 23rdof 2023, Ford’s patent provides a systemic overview of how they envision the merging of technology into the collections and repossession process. Here’s a snapshot of the process.

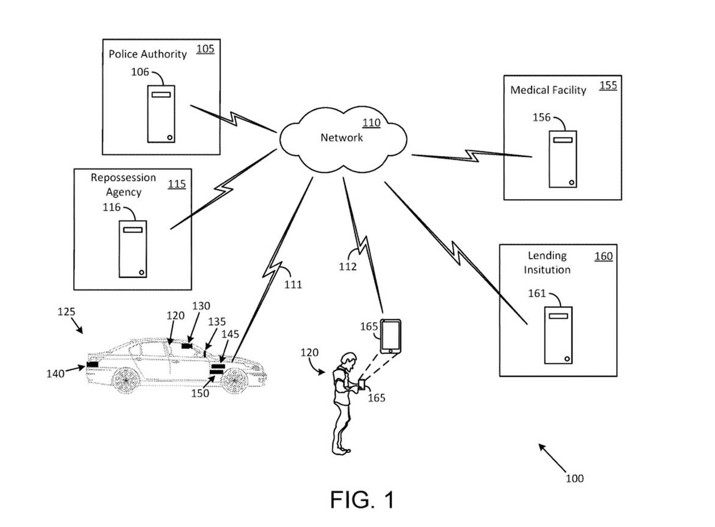

Connectivity

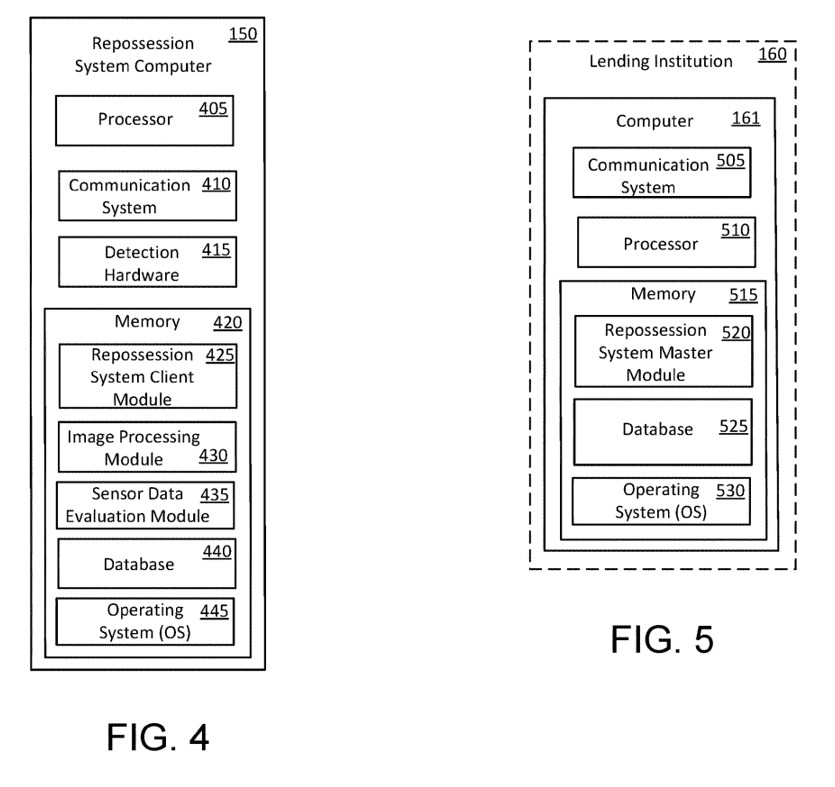

Needless to say, internet connectivity is the key to how this whole process would function. Installed in future vehicles would be a “Repossession Computer.” While it speaks of this device as a separate unit, it states that. “In some embodiments, the vehicle computer may be configured to perform some, or all, functions of the repossession system computer.”

In short, it would also be using vehicle features already installed in the vehicle to help facilitate the repossession. On board cameras, sensors, the stereo speakers, the ignition, self-drive features, would all be incorporated into this process. Pretty straight forward and nothing really ground breaking there.

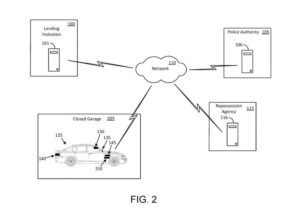

In addition to the simple disabling of the vehicle’s movement, the patent proposes disabling one or more features as a form of warning perhaps. But for vehicles with autonomous or semi-autonomous driving functionality, they propose that the system could “move the vehicle from a first spot to a second spot that is more convenient for a tow truck to tow the vehicle… move the vehicle from the premises of the owner to a location such as, for example, the premises of the repossession agency,”

Also considered, is the lending institutions consideration of “financial viability of executing a repossession procedure” whereas the vehicle could be ordered to simply drive itself to the junkyard. While this seems improbable a judgement for a lender to make on a wired and drivable vehicle, it does somewhat illustrate just how far from the actual lending and repossession process the author is. If a vehicle was in drivable condition, it probably has some reasonable value above salvage and unlikely to go straight to a junk yard.

But the patented process starts far earlier than the repossession according to documents. Just think of an auto interrupt devices early warning lights used before shutting down. Now, just imagine that device connected to all of the wired features of the vehicle in some of the most intrusive ways.

Annoyances

Clearly the opportunity exists to interface collections notices via the onboard infotainment systems. Something to the effect of “Please call you lender” or “Important Notice: Lender Contact Required.” The patent doesn’t state what would be shown, but explicitly does state that “messages, alerts, and or, notices” may be sent by a lender.

How this would pass the sniff test of the Fair Debt Collections Practices Act (FDCPA) is obviously a weakness to this strategy, but they are throwing it on the idea board. Perhaps they weren’t aware of the red light green light beeping warnings of currently existing auto interrupt devices. And if not, they’re clearly not aware of the legislation and outcry from politicians and consumer protection groups over the deployment of these.

It doesn’t take a degree in rocket science to see that the systems connection to vehicles onboard computer could create additional leverage against the borrower. They could hypothetically use this to create a wider range of annoyances such as shutting down the air conditioning, stereo, electric seats, etc.

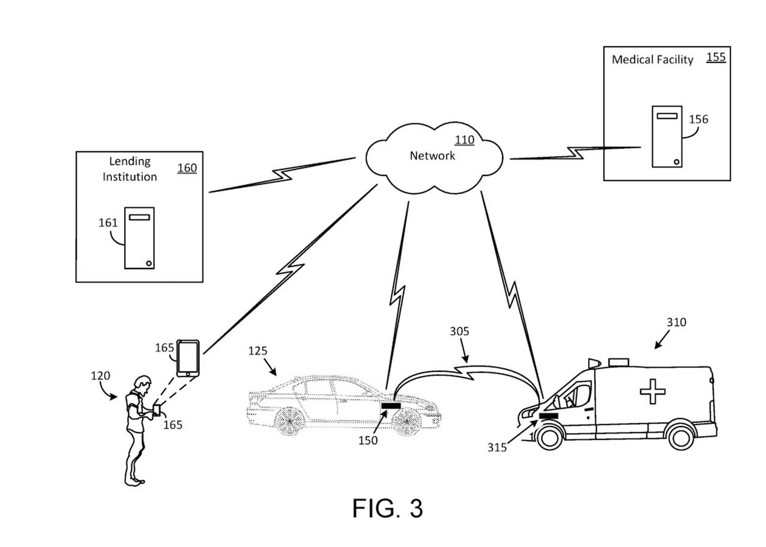

But it’s not like they are completely unaware of the potential for problems in the event of borrower emergency. This has frequently been a rally cry of consumer advocates who warn that shutting off a vehicle or locking a delinquent borrower out could create life threatening scenarios.

As illustrated in Diagram 3, they do seem to have made considerations for such cases. But just how effective this process would be in a life and death situation where minutes could mean lives, it’s still ripe for trouble.

I can’t really imagine that they would want to open this Pandora’s box of harassment, but in the wrong hands, anything could happen I suppose. Which brings me to the next point.

See The Patent Filing Here!

Repossessing

Who exactly is the party that is supposed to be controlling this process?

Ford? Do you really think that Ford wants to jump headfirst into the risk of litigation that could stem from their hands-on employment of these practices? It’s been decades since lenders routinely went to the field to recover their own vehicles and there is a solid reason why they quit. Too many lawsuits and too many employees getting killed.

The widely accepted option of outsourcing has been there since the beginning, so why would they bother? Which brings me to the next possible party.

Repossession agencies. Okay, sounds good, but let’s be honest; not every agency out there is always capable of the soundest judgement. The risk of giving access to a vehicle in this manner to the wrong agency would be like giving a monkey a machine gun. Besides, outsourcing most likely wouldn’t let Ford off the hook legally for allowing them access in the event of harm.

Perhaps the forwarders could manage it? No, wait. I’m just going to stop there. Use your own imaginations on what could go wrong in that scenario.

I’m sure the idea looks pretty exciting from a ten-thousand foot view, but I have serious doubts that anyone has run this through the legal gauntlet of Ford’s attorneys for viability of execution. From a risk reward standpoint, doing anything more than locating it, unlocking it and starting the engine are about the only things that might pass the sniff test.

Not in This World

Makes for some nice click bait, but don’t get too excited, the hurdles to launch are huge.

It is all exciting. Using technology to cut out the face-to-face contact risks. A “repossession center” full of tech savvy remote agents signing into and driving cars secured by delinquent loans back to the command center, and all from the comfort of the office.

But here’s a big question. What would it cost? If anyone thinks that they could get this done for under $500, they’re clearly not looking at the numbers. There is no way that Ford could price model this for less than that taking into consideration the manpower still required, hardware and insurance.

And even if they could, are they just going to go out and open a bunch of satellite storage lots to store them at? Are robots going to inventory and remove the heaps of personal property inside and deal with the irate borrowers?

No, they can’t do that yet. And until they find free real estate and “Rosie the Robot” from the Jetsons to handle the personal property and the “Terminator” to manage the borrowers, they’re still going to need agents.

No, they can’t do that yet. And until they find free real estate and “Rosie the Robot” from the Jetsons to handle the personal property and the “Terminator” to manage the borrowers, they’re still going to need agents.

I live in Silicon Valley, just south of San Francisco. Probably the biggest hotbed of testing autonomous vehicles in the world, and it’s had a good deal of issues to say the least. Partner that with the never-ending stories about accidents caused by people napping while using the Tesla driver assist and you can get a pretty good idea just how far off we are from remote controlled autonomous repossessions.

Is the technology there? Sure, but taking it beyond a locate, open, and start scenario is highly problematic to say the least. I hate to be a buzz kill, but I’m going to be a buzz kill. I suspect that this patent was filed as a “just in case” anchor for leverage should the technology every become standardized. It could be a nuisance lawsuit cash cow.

Sorry for being a buzz kill!

Kevin Armstrong

More Stories

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control