HNS Recovery Demands Unbiased Oversight and Fair Compensation in the Repossession Industry

PLANO, Texas, Sept. 4, 2024 /PRNewswire/ — HNS Recovery, a leader in ethical and efficient vehicle recovery, is calling out the glaring injustices in the repossession industry. With rising operational costs and outdated compensation rates from clients, many repossession companies are being pushed to the brink. Even more troubling is the lack of impartial oversight, which has allowed unethical practices to fester unchecked.

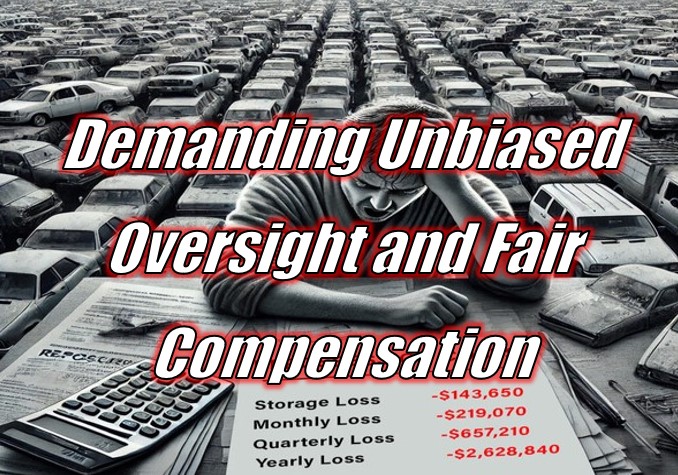

The Crushing Weight of Rising Operational Costs

The repossession industry is facing a financial crisis. Operational costs have skyrocketed, with HNS Recovery facing an average operational cost of $37.71 per vehicle. Despite these rising expenses, the company is only able to collect storage fees on a fraction of the vehicles repossessed.

In July alone, HNS Recovery repossessed 2,000 vehicles but was only able to charge storage fees on 310 of them, leaving 1,690 vehicles for which no storage fees could be collected. With an average storage loss of $85 per vehicle, this resulted in a monthly storage loss of $143,650 and total monthly losses of $219,070 when combined with operational costs.

“Repossession companies are being squeezed dry,” said Mike Aghyarian, Chief Executive Officer at HNS Recovery. “Over a quarter, these losses add up to $657,210, and over a year, we’re looking at a staggering $2,628,840 in losses. The financial strain is unbearable, and yet the clients expect us to keep operating under these conditions.”

Unfair Compensation Practices by Clients

Despite these rising costs, clients refuse to adjust their compensation rates. Most contracts remain stuck at prepandemic levels, ignoring the economic realities repossession companies face every day. These outdated contracts fail to account for the increased expenses required to maintain the same level of service.

“Clients are turning a blind eye to the challenges we face,” Aghyarian stated. “They demand more efficiency and better results, but they’re not willing to pay for it. It’s like asking for a luxury car but only wanting to pay for a used one. The clients need to wake up and recognize that their inflexibility is killing our industry.”

A Rigged System: Bias in Regulatory Oversight

Adding insult to injury, many of the regulatory bodies overseeing the repossession industry are staffed by repossession company owners, creating a blatant conflict of interest. This self-regulation has led to biased policies that prioritize profits over ethical considerations and consumer protections.

“Let’s call it what it is—having repossession company owners regulate their own industry is like letting the fox guard the henhouse,” Aghyarian said. “This system is rigged to benefit insiders who care more about their bottom line than about fair practices. The current oversight structure is a joke, and consumers are paying the price.”

Demand for Independent Oversight

HNS Recovery is calling for the establishment of independent oversight bodies that have no ties to the repossession industry. These bodies would ensure that repossession practices are ethical and that consumers are treated with respect and fairness.

“We need an independent watchdog that has no stake in this game,” Aghyarian asserted. “It’s the only way to ensure transparency, fairness, and accountability. Right now, the system is broken, and the only way to fix it is by bringing in unbiased regulators who will hold these companies to the standards they claim to uphold.”

Time for Change: A Call to Action

HNS Recovery demands immediate action from clients and policymakers to:

Implement Independent Oversight: Establish regulatory bodies completely independent of the repossession industry to enforce ethical standards and protect consumer rights.

Reform Compensation Models: clients must update their compensation structures to reflect the real costs of repossession, ensuring the industry remains viable and ethical.

Enforce Ethical Practices: Develop and mandate ethical guidelines that prioritize humane treatment of consumers and fair practices, with mandatory training for repossession agents.

“The time for talking is over,” said Aghyarian. “We need action. We need reforms that put people over profits and ethics over exploitation. We need a repossession industry that operates with integrity and fairness. And we need it now.”

About HNS Recovery

About HNS Recovery

HNS Recovery is committed to providing ethical, efficient, and secure vehicle recovery services. With a focus on integrity and transparency, HNS Recovery seeks to lead the repossession industry toward a more compassionate and sustainable future.

SOURCE The Car Source dba HNS Recovery

Related Articles:

Sounding the Alarm on Wrongful Repossessions

TX Repo Company Offers Personal Property Delivery

Agency Offers Repo Redemptions with Compassion

Demanding Unbiased Oversight and Fair Compensation in the Repossession Industry – Demanding Unbiased Oversight and Fair Compensation in the Repossession Industry – Demanding Unbiased Oversight and Fair Compensation in the Repossession Industry

More Stories

Rising Fuel Costs Are Impacting Repossession Operations

Colorado Bill Aims to Severely Impact All Repossession Operations

Today is Fallen Agents Day – 2026

From Auction Cutting to Field Programming: The Structural Shift No One Budgeted For

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most