EDITORIAL

22 November 2017 – In a world of lenders and forwarders so scared of the CFPB and it’s view of personal property fees that they wantonly and with complete disregard to the efforts and labor involved with the process, are requiring repossession agencies to waive all fees associated with it, it is refreshing to see a lender make a business decision that is reasonable and profitable to the agent.

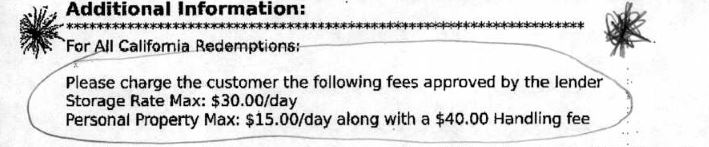

BMW is allowing a $40 Handling Fee and $15 per day storage on personal property in California as shown. They are also allowing $30 per day vehicle storage. While I’m sure the repossession fee is still not in the $480 range, where it should be, it does exemplify a lender who “gets it”.

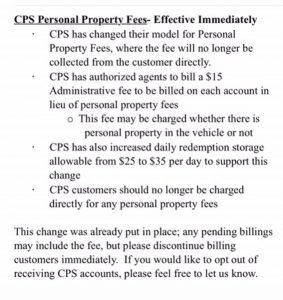

For some of you, this may come as no surprise, but I am finding this out while also hearing that the Forwarder, Consumer Portfolio Services (CPS), is disallowing personal property fees altogether and instead allowing a pittance of $15 in administrative fees. While they have made the move to allow $35 in vehicle storage per day from $25 to the borrower to attempt to make up for this, the collection of those fees is contingent upon reinstatement or redemption.

One other primary difference in these two methods of billing, is that BMW allows the agent to collect the fees directly from the borrower and CPS is collecting these themselves and requiring their agencies to wait for their fees to be paid through accounts receivable, which as everyone knows, can take many weeks at least.

With the recent announcement of Richard Cordray’s resignation from the CFPB, you would imagine some renewed confidence in an easing of the overbearing reign of this autonomous entity under an otherwise, business friendly Trump administration. But, this may be slow to change and the “elephant on a string” that is the banking world, is slow to make changes to adapt to it. And, without any reason to do so, most lenders are unlikely to yield and revert their billing practices that existed before the “Boogie Man” of the CFPB reared it’s head to intervene. Those that do, should be applauded.

existed before the “Boogie Man” of the CFPB reared it’s head to intervene. Those that do, should be applauded.

Great job BMW! Your agents thank you!

BMW gets it Right on Fees – Repossess – Repossession – Repossession Agency – Repossessor – Repossession History

More Stories

A Repo, Gun Threats, Hidden Meth, and a Felon’s Desperate Hideout

ATR Driver Critically Injured in Semi Collision – Needs Help!

Tragedy Strikes Benchmark Recovery Family – Help Needed!

Gun to the Head: Conviction in the Slidell Repossession Nightmare

Undercover ATF Pose as Repo Men to Take Down Illegal Gun Dealers

Gun Drawn on Friday the 13th Repo