November 16, 2016 – Recovery/Repossession businesses across the country recently received a letter from MBSi Corp.—telling these small business owners that they are REQUIRED to purchase and download MBSi’s newest evolution software and operating system, Recovery Connect. Failing to do this, the letter said, would discontinue the ability of the repossession company to do business with Santander Consumer USA, Inc. and Chrysler Capital. No, MBSi didn’t try to sell the use of Recovery Connect system… they DEMANDED that the system be purchased and used.

There are several reasons that blindly following the “required” instructions should be avoided:

The first, and most obvious, concern is the cost to the end-user of the Recovery Connect System. Thirty dollars per month, plus $5 per user per month, may not seem like a lot of money to the people creating and adopting these changes with every “new innovation”; however, the profit margin for the small businesses who actually do the work in the recovery industry has already been squeezed down to a miniscule amount—if a profit even exists! Adding more expense for the “privilege” of working an account from any lender, or through any forwarder, is not an option if many of these small businesses are going to stay in business! In almost any other small business relationship, when the company in need of a service prefers the company providing the service to use a specific platform for the service, the company in need of the service requests that the service be provided on that platform at the expense of the company wanting the platform used.

No less important when working within a small profit margin, is that the use of the Recovery Connect platform will increase minutes and data for which the recovery company pays each month with their phone carrier. It is not the recovery businesses’ expense to bear! This could be deadly to the bottom-line of repossessors—especially if this type of demand grows or is adopted by more clients.

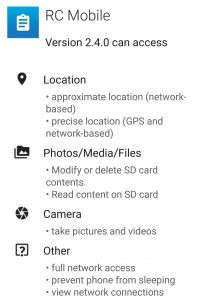

Secondly, even if the platform were free for use by those in the field actually doing the work of recovering collateral on defaulted loans, the use of this platform will require a third party’s software to be downloaded onto repossession company computers, and onto company or personal cell phones. Here are a few of the reasons that is unacceptable to the heart of the repossession industry:

According to the Recovery Connect FAQ’s produced by MBSi Corp., one of the “perks” of the Vendor Comply, complaint-management portion of the Recovery Connect platform is the ability for the lender to schedule follow-ups and tasks for the repossession company to do in connection with any lodged complaint. According to the IRS and CFPB, if a lender is scheduling contacts and directing tasks for our offices to do, we are employees and no longer independent contractors—regardless of what our contracts say! Does this mean these lenders want to provide us with employee benefits and overtime pay? We don’t think so.

Downloading the RC Mobile application onto a cell phone carried by our employees in the field gives MBSi the ability to track the location of repossession field agents using passive GPS location data. Yes, we understand that this “service” can be turned off when the app is not in use, but who decides the settings on employees’ personal cell phone? Not the employer… and not the app generator… except that the default setting is to track field agents. And what are the implications to the lender if the location services are turned off? Also, by installing an application and accepting the required permissions the developer is granted permission to add additional capabilities, and possibly further access, through updates.

Downloading the RC Mobile application onto a cell phone carried by our employees in the field gives MBSi the ability to track the location of repossession field agents using passive GPS location data. Yes, we understand that this “service” can be turned off when the app is not in use, but who decides the settings on employees’ personal cell phone? Not the employer… and not the app generator… except that the default setting is to track field agents. And what are the implications to the lender if the location services are turned off? Also, by installing an application and accepting the required permissions the developer is granted permission to add additional capabilities, and possibly further access, through updates.

If each field agent has “their own Recovery Connect account” that can be accessed on any device, as set out in the MBSi Corp. Recovery Connect FAQs, how can the employer insure that confidential information is kept confidential? It can’t. Portable communication devices were declared vulnerable to the improper use of non-public personal information included in repossession accounts before the CFPB even existed. Cell phones are used for screen shots millions of times each day! Our field agents are trained to understand that this nppi is confidential and must be kept safe; however, there are no guarantees that someone other than the authorized user will not pick up a phone or tablet and see the information as interesting—saving it for sharing or use at another time. When the information is taken outside of the secure environment of a desktop or laptop operating system, the risk increases exponentially. Isn’t there a potential infraction against rules set by the GLB, FDCPA or UDAAP?

Some of the terminology included in the platform makes the industry vulnerable to outside forces. For example, if an account is labeled as “Pending Recovery” AFTER the collateral is “on-hook”, just because a condition report has not yet been completed, the label implies that recovery has not yet occurred. The ramifications in litigation are huge when an issue turns on whether a repossession is complete prior to some other event occurring.

Since this platform allows the field agent to receive “information from the lender in real time”, the possibility for the small business repossession company to lose control of its employees in the field is an unacceptable risk. Lender employees who monitor defaulted accounts may, or may not, be trained in the laws and regulations applicable to a repossession in the field, in a given location. Repossessors often receive instructions from their client’s representatives that are unacceptable in a certain state or locality. Recovery company owners work long and hard to stay updated on the laws covering their operations, and to make sure their employees operate within those parameters. But if some other authority figure on a given account is advising the employee to do “the wrong thing”, and the employer is not in the loop to advise about the local regulations, the employee could easily act in accordance with Client instructions rather than in accordance with the law applicable to the recovery. It is the recovery company owner who then becomes responsible for the illegal activity. That owner should not be asked to give control of field agents and their work product to the lender, just to make communication happen in real time. Synchronized communication is not better if it results in a wrongful repossession.

And since the Recovery Connect platform requires access to the files on the devices to which it is downloaded, what is the assurance to the small business that the information from unrelated files will be secure? Is this too a GLB, FDCPA or UDAAP issue?

Allied Finance Adjusters’ Members, and other small business owners in the repossession industry need, and deserve, answers to these concerns before they are “forced” into a purchase of Recovery Connect. MBSi, if you have something to sell, please sell it to us by convincing the industry that its use is legal, it will work for repossession companies, and its use will result in a larger profit margin rather than a smaller one!

Allied Finance Adjusters Executive Committee

Allied Finance Adjusters Conference (800) 843-1232 Fax (888) 949-8520 www.alliedfinanceadjusters.com

Here you go again, another ‘pay to play’ system that you will agree to because ‘you need the work to pay the bills’. I call BS! Allied wants answers! OK say they give you some answers, whatever the are it’s BS, What if they (Allied) don’t like the answers? Well your gonna have to do it anyway. That’s just the way it is. Just like 20 days free storage, free transport to the auction, stipulations to what you can charge for property, redemptions and on and on and on. WAKE UP PEOPLE!

I have not said anything because nobody listens, sooo, unless you are a millionaire and get out of the business your gonna take it. And I don’t need to tell you where.

I just recently had a discussion with a non-client about storage fees. their repo order stated 20 days free storage and 10 a day after that. The non-client (I was ‘removed’ from their system over the storage controversy in the past) called about a voluntary they needed picked up ‘right away’, I had plans for the evening and told them I could pick it up in the morning first thing, no thanks I’ll call someone that can pick it up tonight. Whomever they called could not get the job done because the vin# was wrong (another reason they where a non-client, fax in fax out, nothing is checked) guess what, they called me back! I got on the phone and they corrected the vin and I picked up the vehicle sent them an invoice stating my storage fees, after the vehicle sat in storage beyond the free days the argument started. the only funny part of this was when the non-client representative told me the excessive storage fees were coming out of his paycheck! They paid the fee and got their clients vehicle, yes it was a forwarder, yes I was accused of being an unscrupulous business owner. And yes I was removed (again) from their list.

My point is keep letting them run your business by DEMANDING free this and stipulated that and you will buy this system or else garbage.

Who’s name is on the business? Who writes the checks? Who deals with the angry people that come to YOUR office and makes a fuss because YOU took their property.

Will Allied help you say no? Will you say no? I don’t think you will.

WAKE UP RECOVERY AGENTS!

I’m not sure who actually wrote this piece but I applaud you! I’d like to hear from you and I am easily found. There is one part of your letter that is not totally accurate and that is the part that the clients don’t get.

” But if some other authority figure on a given account is advising the employee to do “the wrong thing”, and the employer is not in the loop to advise about the local regulations, the employee could easily act in accordance with Client instructions rather than in accordance with the law applicable to the recovery. It is the recovery company owner who then becomes responsible for the illegal activity.”

Lenders take heed. When you dictate when, where and how a field agent works, they are no longer an independent contractor. I’d go all in on a bet that an attorney one year out of law school would win that case. You seek control of recovery company owners, and their employees, with a blind eye towards the exposure and liability you’re bringing upon yourself. You don’t like to hear this, but I know far more than any of lender about the collateral recovery business, as do the professionals in this business that I associate with. Unless your just going with the cheapest company you can find, let us do what we know had to do, and put your focus making loans and training your collectors properly.

Great Article. Just to shed some light on this. From what I understand is Santander is looking to connect directly with the agent in the field and bypass third parties like Forwarders so they can get reported repossessions much faster. That sounds great but the way they are doing it is wrong. The MBSI app lacks what an agent needs. MBSI is not known to take care of the repo company so who knows if they will continue to update the app.

What the industry needs is a central repository for companies like Clearplan, MBSI, RDN, MRS and RMP as well as other companies to push/pull data so Repo Companies can use any system they want.

Working in all these different systems to run your business is crazy.