Q1 2025 – Number of Agencies Up, Number of Employees Still Down

EDITORIAL

It’s no secret that 2025 has been a record year for repossession volume. And as the year winds down to a close, our beloved government is finally getting around to reporting their 1st quarter data on the size of the repossession industry. Within their sparse and aged data are early signs of an industry in the early stages of a growth spurt.

Getting a handle on solid repossession data is a lot like trying to nail the proverbial Jello to a wall, it’s kind of hard to find anything that sticks. So, when the Federal Government provides us with some meaningful data, I suppose we should be grateful.

After weeks of government shutdowns, we are finally able to get a look at The Bureau of Labor Statistics (BLS) data for Q1 2025.

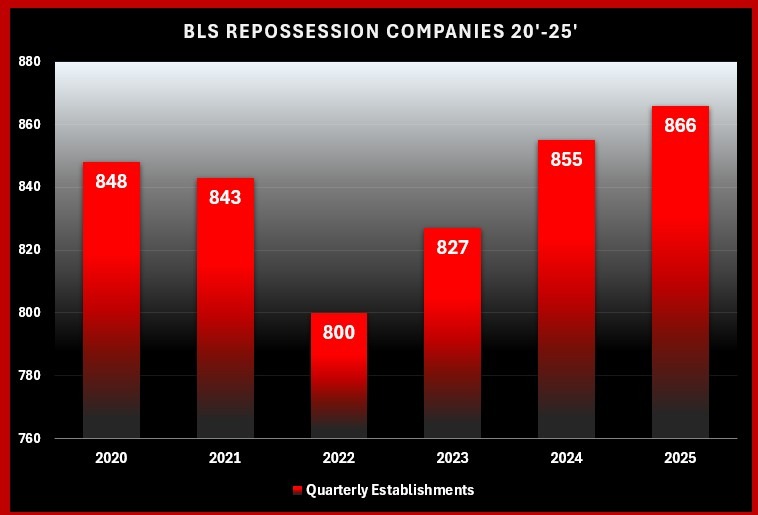

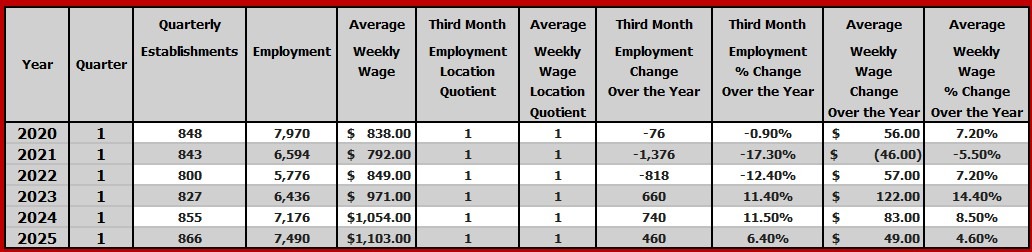

Agency Numbers

While we know that these numbers are light, we can still use them to provide ourselves with some meaningful data on how many reported full-time repossession companies are operating over the past years.

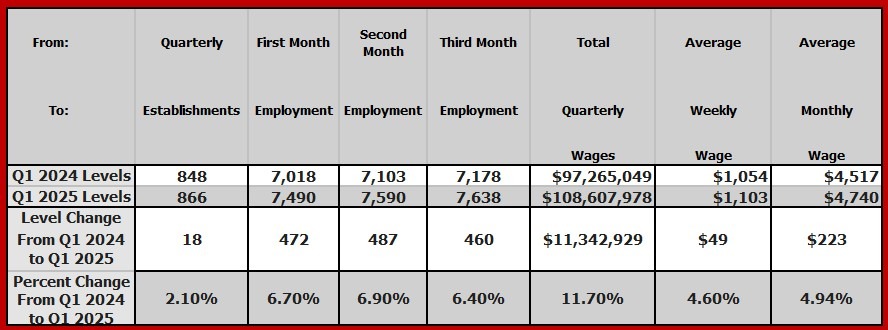

With a reported 866 repossession agencies in operation at the end of the 1st quarter of the year, we can see that there has been some small increase in the number of agencies (+11) when comparing Q1 24’ to Q1 25’.

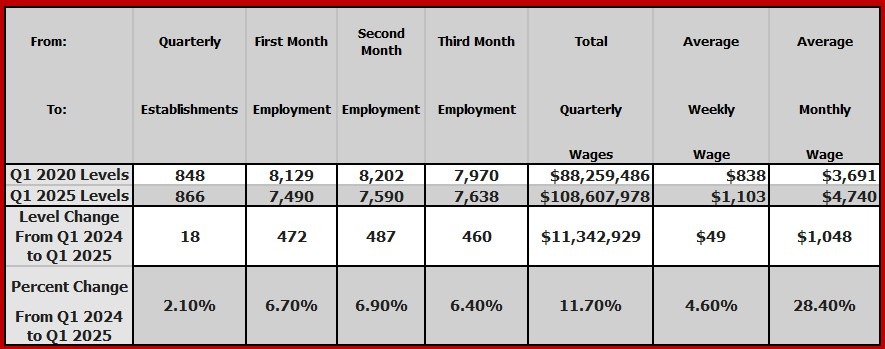

But what is more interesting, is that the industry has grown by 66 newly reported companies since the 2022 downturn. At the same time, during this period, the industry is reported to be 18 companies larger than it was in 2020, which was the first available data set for the industry.

Up front; we all know these numbers are light. As previously reported by RDN, there were 1,272 agencies that conducted at least ten repossession a month in 2024. The BLS numbers are dramatically lower. But the reporting method is the governments and their alone and I am not going to dig too deep into the issue of undercounting. The base numbers themselves are the trends that I wish us to focus on for now.

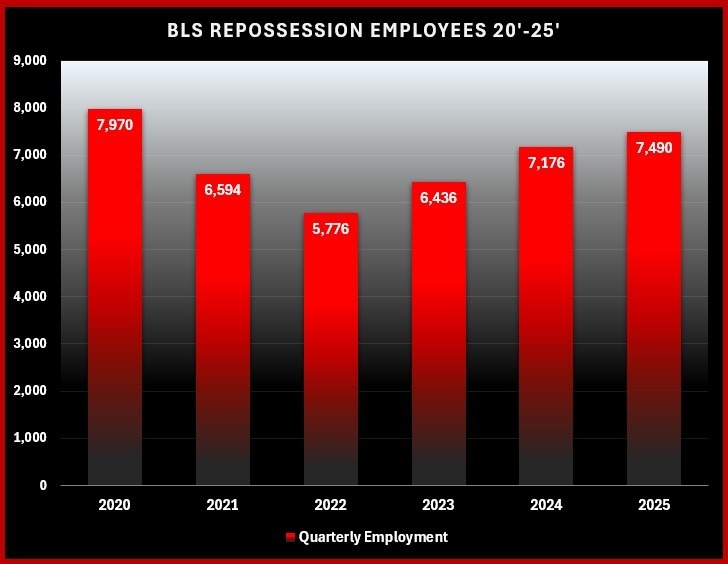

Employee Numbers

Perhaps the most intriguing data point is one which I know many agency owners struggle with, and that is staffing levels.

Again, according to the BLS Data, there were a total of 7,490 employees in the reported data pool for Q1 25’. That is an increase of 314 employees since the same period of 24’. At the same time, it is still 480 employees lower than it was during the same quarter of 20’.

- When comparing staff level changes by month, in Q1 2024 there was an average of 80 new employees added per month. In Q1 2025, that eased to an average of 74 a month.

- While these numbers are promising, agencies are still struggling to find staff. According to this data, the staff levels dropped by 2,194 over the years 2021-2022 (27%!).

- Although an additional 1,714 jobs were filled over the next two years, reporting at 7,490 employees, the industry is still not back to the 2020 level of 7,970.

- With year over year hiring averaging 11.45% per year in 2023-2024, 2025’s drop to 6.40% further illustrates that hiring is getting increasingly difficult.

Perhaps the next data points may explain some of this.

Wages

With the increase in repossession volume came increases in Quarterly Wages.

- According to BLS data, comparing Q1 24’ to Q1 25’, Quarterly Wages rose by an additional $11M, from $97M to $108M. An 11.7% increase.

- One more interesting thing to consider in this data is the average wage per employee that they do not report. If you divide the Q1 25’ total Quarterly Wages to the number of Employees for the third month of the quarter, it is an average of $14,219 per employee per quarter, which drills down to a Q1 2025 monthly average income of $4,739.81.

- This is only a moderate increase of $223 per month per average employee over 2024, a 4.9% increase. But to keep this in perspective, with lower repossession volume of Q1 2020, the average monthly income per employee was only $3,619. This is a monthly increase in wages of $1,120, a 24% increase over five years. Note that this is primarily volume driven.

Conclusions

Following the dramatic exodus of agencies from the repossession industry between the years 2021 and 2022, we have seen a slow and steady increase in the number of agencies that has exceeded the Q1 2020 totals. With repo volume high, it appears as though more companies are jumping into the waters.

Are some or most of these companies that had turned away from repossessions during the downturn and are coming back, or are these a new crop of newcomers entering the fray? Time will tell.

Unfortunately, despite these increases, the industry is having a noticeably difficult time finding staff. As shown, the staff levels are still well behind where they were in 2020 when the BLS started gathering this data.

And while the staff have seen some wage increases, likely due to increased volume, a year-over-year wage increase of 4.6% is pretty miniscule when weighed against inflation. These wages will likely continue to stifle employment gains for the foreseeable future unless agencies begin to see much higher fees paid by the lending and forwarding industries.

One larger question is, how long can these high assignment volume numbers hold up? Lenders are already tightening underwriting guidelines and at some point, the most risky and probable to get repossessed will have run off.

The currently levels of repossession volume are unlikely to hold forever. At some point, they will recede. When that finally does occur, can the industry survive the thin profit margins created by the longstanding stagnant fee environment? Time will tell.

BLS Data Available Here

Repossession Industry Code: 561491

Source: BLS

Kevin Armstrong

Publisher

More Stories

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control

When Oversight Becomes Overreach: Why Demanding Subcontractor Financials Is Wrong

Snitching vs. Standing on Principle: Calling Out Bad Actors in the Repossession Industry

Lender Interference in Georgia Repossessions