The Southeast Regional Repossession Conference in Savannah wasn’t designed to be just another industry gathering—and it wasn’t. Over a day and a half, stakeholders from every corner of the repossession chain sat in the same rooms, engaging in the kind of candid dialogue that typically gets buried in hallway conversations or lost in the noise of larger events.

The format itself was the differentiator. Instead of sprawling ballrooms filled with hundreds of attendees listening to polished presentations, this conference prioritized interaction. Repossession agencies, forwarders, lenders, vendors, and insurers weren’t just in attendance—they were actively wrestling with real problems together, often for the first time.

The format itself was the differentiator. Instead of sprawling ballrooms filled with hundreds of attendees listening to polished presentations, this conference prioritized interaction. Repossession agencies, forwarders, lenders, vendors, and insurers weren’t just in attendance—they were actively wrestling with real problems together, often for the first time.

This was the most effective repossession conference I’ve attended. Not because of amenities—though the AC Hotel’s location on the Savannah River was certainly pleasant—but because the structure worked. It forced conversations that normally fragment across social media threads or get watered down in corporate communications into the open, where every stakeholder had to confront them simultaneously.

The logistics weren’t perfect. Parking presented challenges, and the hotel’s conference capacity was tested with just over 180 registered attendees. But these minor friction points only underscored the event’s success: this was about as large as the venue could handle, creating an intimacy that larger conferences can’t replicate.

What emerged was something I believe the industry has been missing—a forum where upstream decisions and downstream impacts could be discussed in real-time, with all parties present to defend their positions and explore solutions. This conference convinced me that regional events may be the most effective model for driving meaningful change in the repossession industry.

Technology and Safety in Focus

The conference’s most gripping moment came during a panel discussion with RDN, when Brian Dean of Undertow shared a chilling field story. Dean recounted how one of his agents had been shot at during what appeared to be a routine repossession. The agent, unharmed but shaken, immediately disengaged and drove away. Video from the truck captured the incident in stark detail.

RDN’s newly launched violence-tracking feature was designed for exactly this scenario. Dean’s team flagged the assignment as violent, ensuring it would be closed in their system. But days later, another repossession company—also working through RDN—secured the same vehicle and discovered a firearm inside. Despite the violent flag, the warning never reached the other agency.

The breakdown wasn’t due to a failure inside RDN itself, but to the fractured nature of repossession technology. Dean’s agency flagged the order, but the information never crossed into the LPR (License Plate Recognition) platform being used by the second company. Nor was the client’s case management system integrated to pass along the warning. Three separate systems were operating in silos, leaving the second agent exposed to the same danger.

Dean’s team could think of only one guaranteed solution in their after-action review to prevent similar future events and help protect industry agents: mark the collateral as “repossessed” even when it wasn’t, forcing all systems to close the account across platforms. The suggestion triggered audible reactions throughout the room. Field agents like myself nodded in understanding—it’s the kind of practical workaround that makes sense when lives are at stake.

But lenders pushed back hard. Representatives from Ally Financial reminded everyone that marking an account repossessed launches a complex chain of downstream processes, including consumer notices and auction updates, that can be extremely difficult to unwind while ensuring everyone they would be discussing the larger issue again internally.

Forwarders raised their own concerns, noting that violent flags currently generate little more than an internal banner in RDN that is only visible when you go to the case along with a passive update that is buried in mountains of other data. They urged stronger safeguards and real-time alerts that would allow them to immediately pull accounts from circulation.

RDN confirmed the feature was built in collaboration with ARA’s technology committee, but the exchange made one thing clear: true safety requires collaboration across the full chain of stakeholders. I suspect the committee may be represented industry wide, but some viewpoints were either missed or not represented in the initial product rollout.

The most sobering detail emerged at the session’s end—representatives from the lienholder (not Ally) that owned the collateral were in the room and had no idea the incident had even occurred.

In that moment, the value of this conference format crystallized. This wasn’t a hallway debate or a vendor demo—it was every sector of the repossession industry confronting an unresolved problem together. No solution was reached, but the urgency was undeniable, and every stakeholder walked away understanding their role in the larger safety equation.

MV Track & DRN: Professionalism and Accountability

If the violence-flag session revealed the risks of siloed technology, the presentation with MV Track and DRN spotlighted a different but equally pressing theme: professionalism and accountability in upstream decision-making.

Ryan from MV Track introduced the company’s forthcoming Preferred Agency Program. Unlike older models that may have leaned a little too heavily on recovery numbers as a performance marker, this program will emphasize compliance, complaint reduction, and quality of execution. While he didn’t explicitly use the word “professionalism,” the intent was clear: MV Track wants to partner with agencies that bring more than volume to the table.

Tracy from DRN followed with remarkable candor. He admitted that when he first started with DRN, the company seemed overly “results-driven” and volume-focused, aiming to increase valuation ahead of acquisition. That push meant more scans, more data, and more repossessions at almost any cost. But since Motorola’s acquisition, the focus has shifted. DRN is now investing in quality over quantity, working to undo practices that had undercut its own agent network.

Tracy pointed specifically to bulk data sales that devalued DRN’s network. Data was being resold back into the industry at lower prices, eroding the royalties agents depended on. “We care about how our data impacts our agent network,” he said—a simple statement that carried considerable weight.

He also acknowledged the persistent problem of double assignments—multiple agencies being sent the same order. While DRN is working to limit it within its own platform, he was blunt: the problem cannot be solved unless lenders themselves stop spreading assignments across multiple providers. The responsibility, he emphasized, must be shared across the chain.

Both speakers highlighted the growing influence of associations in shifting industry direction. Tracy credited state and national groups with giving agencies a collective voice. If a concern comes from a single agency, it does not carry the same weight as a concerned carried from an association representing a larger section of the industry was the message.

Together, MV Track and DRN signaled a potential shift: upstream players may be beginning to recognize and openly admit that their choices ripple downstream, directly impacting the safety, profitability, and viability of repossession agencies.

GALR and the Power of Mentorship

John Newberry, president and co-founder of the Georgia Association of Licensed Repossessors (GALR) and owner of Eagle Recovery, brought a candid perspective to the stage. He reflected on GALR’s journey—its early successes, its missteps, and the crossroads the association faces today.

Newberry admitted that in its early days, GALR tried too rigidly to enforce membership standards. Every compliance and professionalism box had to be checked, or membership was denied. In hindsight, that approach excluded companies that might have benefited most from guidance.

Over time, GALR recognized its greatest impact lay not in gatekeeping, but in mentorship. Instead of turning companies away, it began working with those that were struggling, coaching them toward stronger foundations. “The opportunity,” Newberry explained, “is not in turning them down, but in coming alongside them.”

That philosophy was visible throughout the conference. Several companies attending had never been to an industry event before. Some admitted to having only a limited grasp of compliance basics or how to fully leverage tools like RDN. Rather than being dismissed, they were met with offers of help. I watched larger agencies exchange phone numbers, open doors, and extend mentorship to newcomers.

This represented a cultural shift I’ve observed growing in recent years. For decades, repossession companies were notorious for guarding knowledge and holding “trade secrets” close. At this conference, the opposite took place: collaboration and knowledge-sharing became the norm. It was refreshing to witness, and a sign that the industry is maturing in important ways.

The session’s most charged moment came when the question of licensing arose: should Georgia require repossession agencies or individual agents to be licensed? Some argued licensing could rein in bad actors and safeguard against large, underprepared entrants like Copart. Newberry remained neutral, acknowledging merits and risks on both sides.

I find myself firmly opposed to licensing, for reasons I’ve written about before. Once lawmakers legislate standards by statute, industry expertise becomes secondary to legislative text, and courts default to law rather than professional standards. That shift could erode our ability to lead ourselves and diminish the role of future association leaders in shaping standards. In my experience, we’re better served by raising our own bar than inviting government oversight.

A show-of-hands poll confirmed that most Georgia attendees opposed licensing at this time. Only one or two supported moving in that direction. For now, at least, Georgia’s answer is clear.

The session underscored the balancing act associations face: raising standards without shutting out those who need help and pursuing reform without surrendering the industry’s right to define itself.

Training and Safety

Chris Kelly of United Auto Recovery shared a candid story about his entry into the industry: three days of training, followed by being handed a stack of paperwork and told, “You’re the repo guy now.” Decades later, Kelly has channeled that rough start into something better—the Recovery Master Program, developed to train agents in safety and professionalism. The program, initially internal, is now available externally to other agencies. Kelly’s message was clear: sharing best practices and training resources makes the industry stronger and safer.

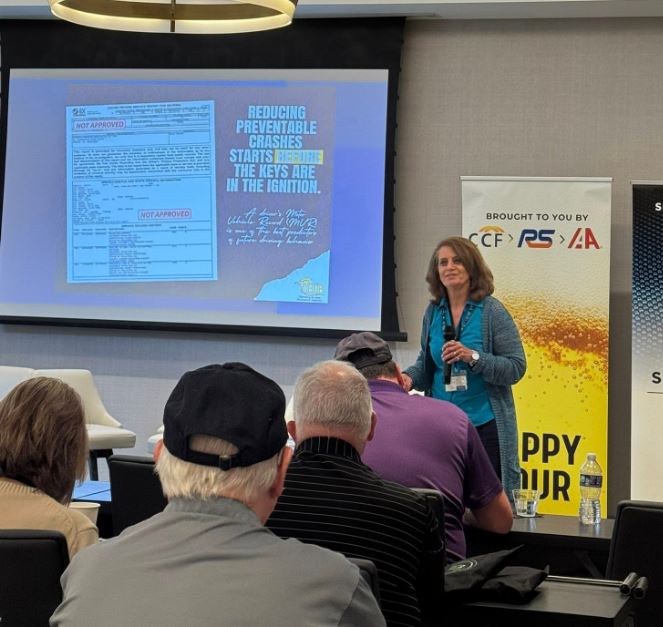

On the insurance side, Renee Lowe of Harding Brooks emphasized the importance of incident reviews and accountability. She encouraged agencies to use the “ask why five times” method—probing deeply into incidents not to assign blame, but to uncover process failures and replicate what works. Importantly, she reminded attendees that even non-fatal or non-damaging incidents deserve review. Learning from near-misses is just as valuable as learning from crises.

Lowe also addressed transport theft—a growing issue as criminals exploit open data channels to impersonate legitimate transporters. She urged agencies to require transporters to provide insurance documents directly from carriers, not copies handed to them, and to secure agreements that define liability. “Your safety armor,” Lowe concluded, “is built on training, meetings, and documentation.”

Her words resonated with me and many others in the room. Too often in our industry, we think of “safety” only in terms of avoiding violence in the field. But what Lowe and Kelly emphasized is broader: professionalism itself is a form of safety. The more disciplined our training, the more consistent our reviews, the tighter our contracts, the less room there is for chaos to creep in. That’s not just about protecting agents—it’s about protecting the entire chain, including clients, consumers, and our industry’s reputation.

Client Panel: Upstream Perspectives

The client panel brought lenders and forwarders into direct conversation with agencies, revealing both progress and persistent challenges in industry relationships.

Ryan from MV Track announced software enhancements in the works that aimed at automating invoicing for agencies—a development that could eliminate one of the most persistent friction points in repossession operations. For agencies that have struggled with missed ancillary fees and complex billing processes, this represented a potentially significant competitive advantage.

As Ryan with MV Track was talking, my thoughts wandered to how much control our businesses should really hand over to clients. Automated mapping, pre-loaded addresses for field teams, and now the prospect of clients managing our internal billing — it all sounds efficient on the surface. But efficiency often comes at the cost of insight and autonomy. Too many times we’ve been shown tools that promise to save time, only to realize they separate us from the levers of our own business operations. Would we be worse off if we removed the pain of billing — the same way consumers feel less financial “pain” when they swipe a card instead of paying with cash? Hard to say. But for my part, I’m not convinced that giving away more control to lenders and forwarders is the best path. Decoupling our businesses from client-driven systems, rather than deepening dependence, may ultimately prove the stronger course.

I also couldn’t help but compare our industry to others and how unnatural some of our requests/demands are. Landscapers, electricians, and utilities all send their own invoices. If a service isn’t billed, the client doesn’t rush to pay it anyway. Yet in repossession, agencies often find themselves hoping that upstream partners will notice and correct missed invoices. While I understand the emotional frustration with billing complexity, I think we’re often barking up the wrong tree. The solution isn’t getting clients to automate our invoicing—it’s learning to be better businesses ourselves.

Keith from Victory Recovery Services delivered one of the session’s most pointed observations: the $275 rate that some orders still pay is “a 1980s and 1990s rate” that makes profitability impossible in today’s environment. His blunt assessment cut through industry politeness, offering advice from someone who has worked both sides of the equation—first as an agent in the field, later as a forwarder.

As Keith was speaking, I silently agreed, we need to start realizing the cost associated with managing the complexity of the industry into the cost of our services so there is room for our companies to meet the client requirements. This concept alone could eliminate many of the burdens we bring upon ourselves as industry colleagues.

As Keith was speaking, I silently agreed, we need to start realizing the cost associated with managing the complexity of the industry into the cost of our services so there is room for our companies to meet the client requirements. This concept alone could eliminate many of the burdens we bring upon ourselves as industry colleagues.

I’m not sure which client said it at this point, but one of them said it directly – “You all need to stop undervaluing each other,” there is always someone willing to do it for less.

Danny from Ally Financial reinforced the growing influence of associations, again underscoring conversations with individual companies often miss the mark, while discussions with associations are clearer, more informed, and harder to ignore. “When you all speak as a group,” he said, “we’re listening.”

The panel also addressed the complexity of fee approvals and complaint responses. Danny explained why Ally always requests supporting documentation when consumer complaints arise, even when the agency isn’t at fault. The rationale is protective: collecting information upfront makes it easier to defend the case later, whether in litigation or regulatory review.

When asked about future industry changes, Danny pointed to systems integration as the next frontier. Lenders are investing heavily in platforms like RDN, but too often agencies fail to fully adopt the same tools, creating operational friction and missed opportunities.

Fundraising and Industry Unity

Beyond the panels and sessions, attendees raised over $26,000 for the Recovery Agents Benefit Fund (RABF)—a staggering figure that outpaced some national conferences. The RABF provides financial support to repossession agents and their families in times of injury or tragedy. While $3,500 per incident remains the current cap, the funds raised in Savannah will help ensure more families receive assistance when they need it most.

The fundraising success underscored both the strength of industry unity and the effectiveness of the regional conference model. By keeping the scale manageable, organizers created an environment where relationships were personal, issues were specific, and collective action felt both possible and necessary. In my view, this demonstrates that regional events may be more effective than national conferences for driving both meaningful dialogue and tangible results.

Closing Thoughts

The success of the Southeast Regional Conference was the product of extraordinary collaboration. Organizers like Suzanne, Amy, Mark, Clayton, John, and others built a program that balanced structure with flexibility, creating space for serious conversations to unfold naturally. Sponsors, too, played a critical role by putting their capital and presence behind the event, making it possible to bring stakeholders together in one room.

Looking ahead, there was already talk of a follow-up event next year. The momentum built in Savannah suggests this regional model is not only viable, but essential. By keeping the scale manageable, it allowed every voice—from agents to lenders to vendors—to be heard, and every issue to be taken seriously.

This was the best repossession conference I have ever attended. The format worked. The conversations mattered. The impact—from the $26,000 raised for RBF to the candid exchanges on safety, professionalism, and accountability—was real. This event set a new bar for what repossession conferences can and should be, and I believe it will shape how our industry approaches these gatherings for years to come.

My advice is simple: if you weren’t in the room this year, make sure you’re there next time.

Wes Carico,

Vice President

Artis Recovery

More Stories

Have You Cast Your Vote?!

Resolvion Announces Appointment of Ronald Eubanks as Executive Vice President of Client Strategy

TexasARP Is Looking for You!

American Recovery Service Partners with InsightLPR in Seismic Shift to Recovery Landscape

MBSi and VINchex Launch Automated Lien Verification Solution to Address Wrongful Repossessions

Big Agenda Updates at NARS 2026