GUEST EDITORIAL

You would never assume a general contractor is the best person to handle the electrical work when building a structure, so why do lien holders assume that forwarders (brokers of repossession assignments) are the best choices to manage their accounts or know anything about the reality of repossessing collateral from a field service perspective? Does a forwarder that has a field services arm have someone running the forwarding side that understands the field service business on a granular level making them a better choice than a field service company whose survival depends on their execution day in and day out?

Attempting to reign in unfair treatment of consumers in the auto industry, the CFPB has issued rules and opinions that either directly or indirectly impacted the ability of today’s repossession companies to charge ancillary fees to consumers. These fees carry invoice titles such as “Personal Property Fees,” “Redemption Fees,” etc. and were an important factor for most companies in maintaining good financial health. Inhibited from charging and collecting these fees, companies suffer significant financial losses.

As field service repossession companies struggle to overcome the impacts of these financial losses, their repossession clients (lienholders and brokers/forwarders) have been slow to respond, and some are even ignoring the consequences and potential outcomes.

Most of these clients are likely to understand very little about the costs associated with operating a field service repossession company. From their perspective, there is little incentive for these clients to try and understand it and so most do not.

To help illustrate the potential harm these clients are causing field service repossession companies, we need to first outline some facts that are common among most companies, apply some simple math, and then we can begin to highlight some of the tough choices these companies are left with.

- Forwarding Companies (brokers of open repossession orders) are the main source of income for most field service repossession companies.

- If the field service repossession company exists in a market with any competition at all, the company has little to do with setting initial contract prices.

- Few clients offer or consider any increases in pricing after the initial contract signing even when inflation continues year after year.

- Very few contracts exist today that allow for non-contingent pricing or close fees.

Taking data from known real life contracts, I will use an average charge of $280 for an involuntary recovery. This base does not include any ancillary billing and is higher than a couple of the contracts my company has with its forwarder clients. It is, however, within 10% of all the forwarding contracts we have and a few of our direct clients.

Without getting into the breakdown of the actual numbers, we spend roughly $130 on average for every unit we recover in payroll. This amount, $130, is 46% of $280, not to mention that 27% of the $130 goes toward taxes and worker’s compensation (that is a topic for another time). We run anywhere from 36% to 48% of our gross billables paid in payroll depending on our efficiency and billables. That percentage includes ancillary fees.

According to author William Adkins, labor intensive businesses typically spend 20 to 40 percent of their gross billings on labor costs. He also states that it is not uncommon for service-based businesses to see labor costs as high as 50% of their gross revenue streams. Adkins, William. “How to Calculate the Employee Labor Percentage.” Small Business – Chron.com, http://smallbusiness.chron.com/calculate-employee-labor-percentage-15980.html . 31 January 2019.

Our equipment averages around 10 miles per gallon as a fleet and the national average for a gallon of diesel according to eia.gov is $3.05 at the time this article was first drafted. We normally pay about $150 to change the oil in one of our trucks and last year we were doing this at around 7,000 miles. A typical truck payment is around $2K (low end) for the truck and LPR cameras per month. Insurance per truck can be estimated at $500 per asset and $500 for garage keepers per location if you are extremely lucky and have very few run losses.

Using just the above figures we can start to calculate costs based on projections. Here are a couple of points I would make – Any quick pay penalties from clients are not represented, nor did we include any loss projections for client denials (usually 3% to 5% just over client billing rules and most notably on ancillary billing), and finally we did not include any tech costs. Just RDN and ClearPlan costs were used to estimate software. We assume one truck and basic user plans (it could differ a little depending on account and client makeup, but you can offset it either way in the profit line to adjust your results if you need more than an illustration).

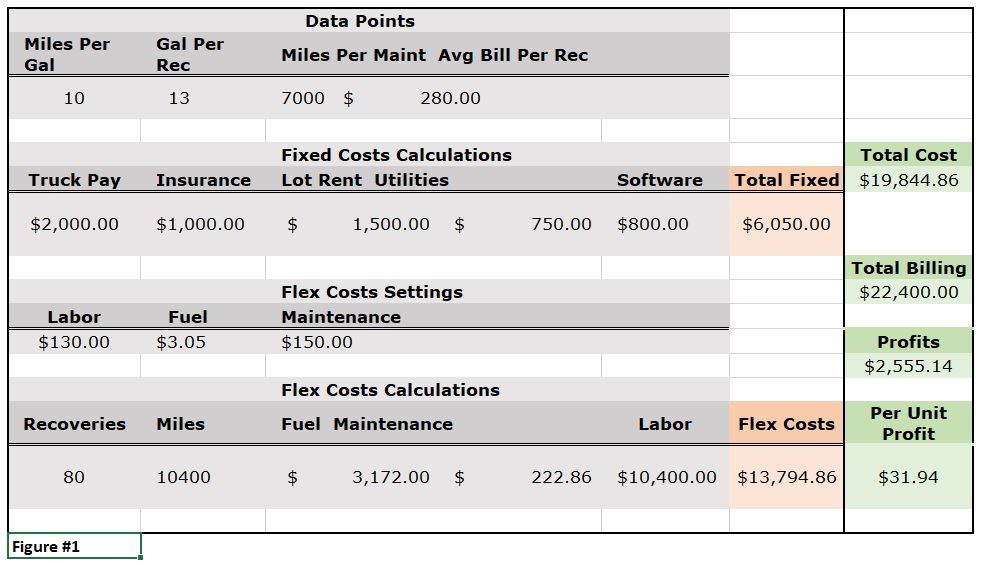

Figure 1 – Shows Straight Billing at an average of $280 per unit (all invol). No Ancillary Fees. I know our margins are slimmer because of other expenses and losses not shown. This is to illustrate a point of loss, not to represent forensic accounting of expenses.

This means that if you have a claim of $100, you will need to pick up 3 plus units to cover that loss. $1200 for a set of tires for your truck is 38 recoveries.

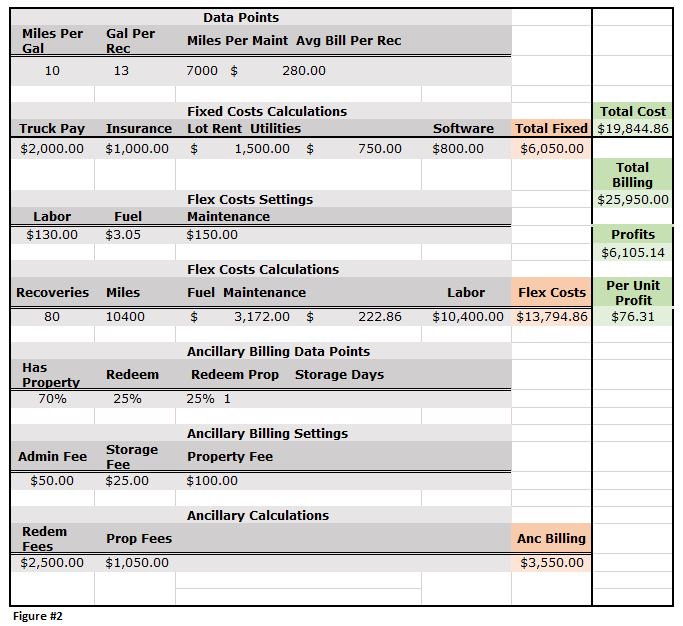

Figure 2 – Shows billing with ancillary fees.

As lien holders and clients become more and more concerned (justifiably or greedily) over ancillary fees, the above table becomes a closer representation of the potential profits per unit for field service repossession companies.

Using the same billing, cost, and understandings above we can inject ancillary billing and start to calculate potential billing projections and losses.

Our company knows that around 70% of the collateral we recover will have personal property. Around 25% on average redeems their vehicle depending on the time of year and lien holder makeup of the recoveries. The collateral left that has personal property has about a 25% property redemption rate as well. Our Ancillary fees last year were a $50 Admin Fee on Redemptions, $100 property Fee, and a $25 per day storage. Because of client restrictions on storage being billed to customers, our average rate of billable days fell from nearly 5 days to one day last year alone. The math results in around $45 per recovery in ancillary billing and is represented below (figure 2) in table form.

When you remove ancillary fees from the equation, you can see a company loses roughly 58% of their profits per recovery. Our company has gone from around $45 to $25 per recovery in ancillary redemption fees and when we factor in these figures, we can see our company suffers from a 44% actual profit loss.

This is represented in straight profit losses because the costs associated with the recovery do not go away with the loss of the “ancillary” revenue stream. The service and costs exist based on the recovery.

For those companies new to the industry with more recent contracts that have higher involuntary pricing, it is important to remember that these ancillary fees were the only tool that companies had to offset inflation and operating expenses yearly as your clients must agree to increases on items billed back to them for payment. Therefore, plan wisely.

We have seen two increases with our businesses in 10 years. One in our delivery rates to a specific auction for a direct client and another increase for direct assignments from a broker. Neither was over $5 per item.

Companies are now faced with much tougher decisions. As a result, companies are running tires longer, increasing times between oil changes, reductions in safety upfits on equipment are considered, cutting employee wages, eliminating customer service positions and reducing lot hours. Some companies may even be ignoring compliance and safety protocols to save time and money. The domino effect is also another discussion as we have not mentioned late fees, overdraft fees and other charges that may now be impacting companies.

We can debate how and what companies should and should not be doing, but I think it is clear that these changes will encourage more companies to become more assertive in their recovery efforts and have major implications on companies’ ability to maintain their previous standards around compliance, customer service, training, and safety.

The secondary potential repercussions of these losses could include increased employee theft, increased insurance claims, increased customer complaints, decreased customer and client service, and higher tensions between companies and their clients.

~ It does not surprise me that insurance companies are scared to cover this industry. They know risk when they see it. ~

My advice to the field service repossession companies like mine; resist the urge to become more assertive, train harder, invest in educating your team on making solid business decisions in the field on every recovery, know which clients are partners and which ones are leaches. Manage your liabilities by telling clients “no”, watching out for assignments with little chance of recovery, and do not allow your team to invest their time in working for clients and other companies who push additional work to your team to cut their labor and/or operating costs instead of handling and managing their own business.

Irresponsible clients who fail to provide increases to their vendors are only exposing their clients and/or consumers to increased liability and risk long term. This practice even begs the question; is it the wholesale slaughter of mature field service repossession companies for profit or just ignorant manslaughter these brokers are committing?

We can tackle that question in the next article or so!

Wes Carico

Nostalgic Towing & Sales, LLC

Ancillary Fees – The Associated Issues with Safety and Quality – Repossession – Repossession History

More Stories

Bad Apples in the Repossession Industry

Why Self-Help Repossession Is Taken for Granted — and Why Losing It Would Hurt Consumers Most

A Necessary Distinction: Financial Oversight vs. Financial Control

When Oversight Becomes Overreach: Why Demanding Subcontractor Financials Is Wrong

Snitching vs. Standing on Principle: Calling Out Bad Actors in the Repossession Industry

Lender Interference in Georgia Repossessions